Defining customer engagement policies

5 Tasks

15 mins

Scenario

U+ Bank has recently completed a pilot project where customers see a single offer, the Standard card offer when they log in to their account page on the bank website.

The business team now wants to introduce three more credit card offers and implement engagement policies to ensure that customers receive only tailored relevant offers.

Following best practices, the business team categorizes the engagement policies into three groups:

- Eligibility rules, which are strict rules that represent what it is possible to offer.

- Applicability rules, which represent business practices that limit what to offer based on a customer's current situation. These rules are not as strict as eligibility rules.

- Suitability rules, which represent what the business should and should not do ethically and empathetically. These rules are the least strict rules.

Some of the criteria apply to the entire Credit Card group, and some apply to specific actions. The detailed requirements are shown in the following tables:

|

Action |

Type |

Condition: Customer… |

|

All credit cards |

Eligibility |

is at least 18 years or older |

|

All credit cards |

Applicability |

does not have a credit card |

|

Standard, Rewards |

Eligibility |

has been a customer for less than or equal to 90 days |

|

Rewards Plus & Premier Rewards |

Suitability |

Is not financially vulnerable |

Use the following credentials to log in to the exercise system:

| Role | User name | Password |

|---|---|---|

| Decisioning Architect | DecisioningArchitect | rules |

Your assignment consists of the following tasks:

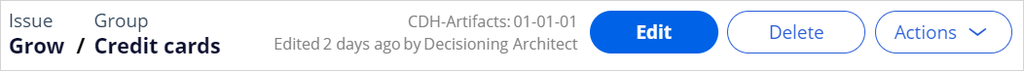

Task 1: Review the existing engagement policy conditions

Review the Next-Best-Action Designer settings to view the existing engagement policy conditions in the Grow > Credit cards node.

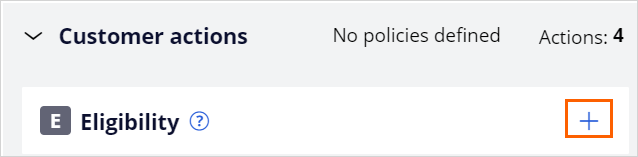

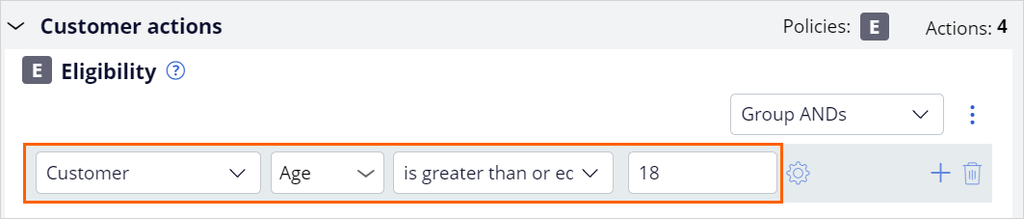

Task 2: Define group-level eligibility conditions

Define the eligibility conditions at the group level based on the business requirements. The following table provides the information you need to define the condition.

|

Action |

Condition |

Expression |

|

All credit cards |

Customer is at least 18 years or older |

Age >= 18 |

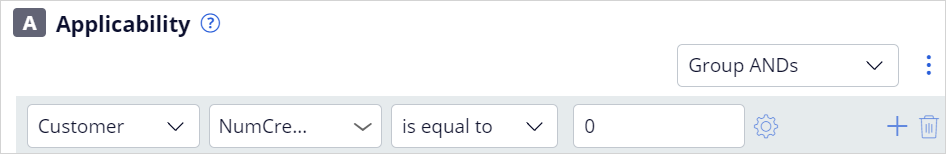

Task 3: Define group-level applicability conditions

Define the applicability condition at the group level based on the business requirement. The following table provides the information you need to define the conditions.

|

Action |

Condition |

Expression |

|

All credit cards |

Customer does not have a credit card |

NumCreditCardAccount = 0 |

Task 4: Define action-level engagement policy conditions

Define the engagement policy conditions at the action level based on the business requirements. The following table provides the information you need to define the conditions.

|

Action |

Condition |

Expression |

|

Standard & Rewards |

Customer has been a customer for less than or equal to 90 days |

RelationshipLengthDays <= 90 |

|

Rewards Plus & Premier Rewards |

Customer is not financially vulnerable |

IsFinanciallyVulnerable = false |

Task 5: Verify that customers Troy and Barbara get the right offers per their profiles

Verify that customers Troy and Barbara get the correct offers for their profiles. Use the information in the following tables for verification.

|

Customer |

Is in Collections |

Debt-to-Income ratio |

Age |

RelationshipLengthDays |

NumCreditCardAccount |

IsFinanciallyVulnerable |

|

Troy |

false |

45 |

26 |

88 |

0 |

True |

|

Barbara |

false |

35 |

32 |

364 |

0 |

False |

|

Customer |

Standard |

Rewards |

Rewards Plus |

Premier Rewards |

|

Troy |

Y |

Y |

||

|

Barbara |

Y |

Y |

Challenge Walkthrough

Detailed Tasks

1 Review the existing engagement policy conditions

- On the exercise system landing page, click Pega CRM suite.

- Log in to Customer Decision Hub as the Decisioning Architect with user name DecisioningArchitect and password rules.

- In the navigation pane Customer Decision Hub, click Next-Best-Action > Designer.

- In Next-Best-Action Designer, click Engagement policy to access the engagement policies for all issues and groups.

- In the Business structure, in the Grow section, click Credit cards to view the group-level engagement policy.

- Expand the All actions section, and then confirm that the existing engagement policy conditions is part of the Financial Services framework.

2 Define group-level eligibility conditions

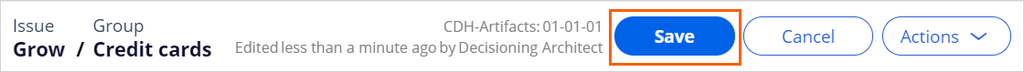

- In the header of the Credit cards group, click Edit to edit the engagement policy of the group.

- Expand Customer actions, and then in the Eligibility section, click the Add icon to define the group-level eligibility conditions.

- In the first drop-down list, ensure that Customer is selected.

- In the second drop-down list, enter or select Age.

- In the third drop-down list, select is greater than or equal to.

- In the fourth text entry field, enter 18.

3 Define group-level applicability conditions

- In the Applicability section, click the Add icon to define the group-level eligibility conditions.

- In the first drop-down list, ensure that Customer is selected.

- In the second drop-down list, enter or select NumCreditCardAccount.

- In the third drop-down list, select is equal to.

- In the fourth text entry field, enter 0.

- Click Save to save the group-level engagement policy.

4 Define action-level engagement policy conditions

- On the Engagement policy tab of Next-Best-Action Designer, in the Offers section, click Standard card to open the card offer details.

- In the upper right, click Check out to check out the group-level conditions.

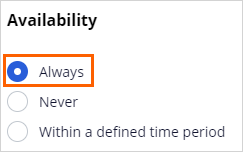

- On the Details tab, in the Availability section, ensure that the that Always is selected .

Note: An action that is set to Never means that the offer is unavailable for presentation to the customers.

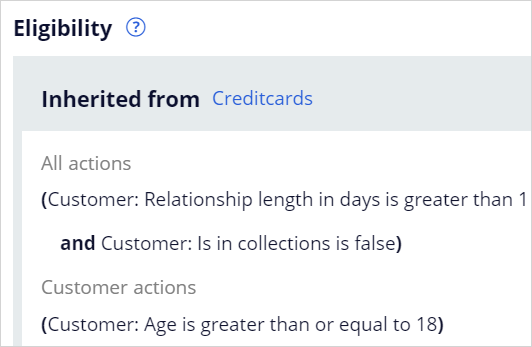

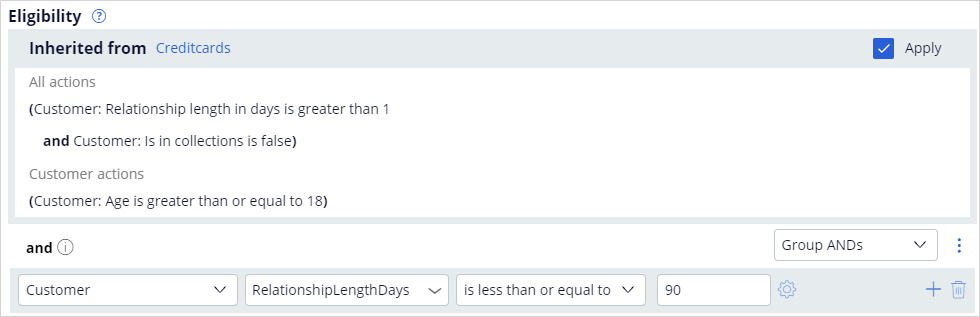

- Click the Engagement policy tab to define the action-specific engagement policy.

- On the Engagement Policy tab, notice that the group-level engagement policy is displayed.

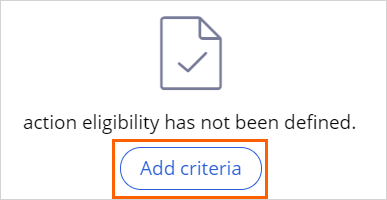

- In the Eligibility section, click Add criteria to add the action-specific suitability criteria.

- Similar to the group-level condition, enter the following condition:

- In the first drop-down list, ensure that Customer is selected.

- In the second drop-down list, enter or select RelationshipLengthDays.

- In the third drop-down list, select is less than or equal to.

- In the fourth text entry field, enter 90.

- In the action, click Check in to save the changes, and then enter a suitable comment when prompted.

- Close the action to return to Next-Best-Action Designer.

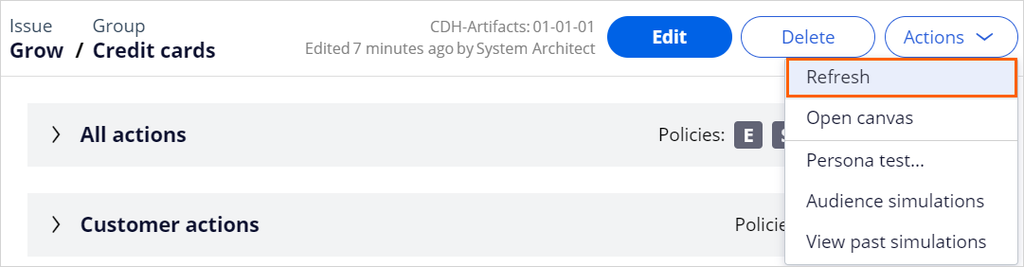

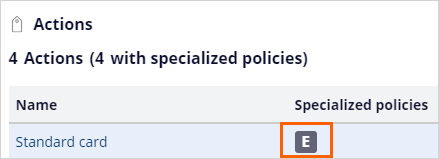

- On the Engagement policy tab of Next-Best-Action Designer, click Actions > Refresh to view the action-level engagement policy type added

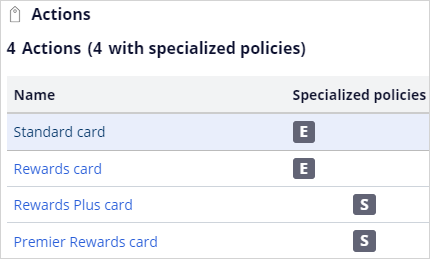

- Repeat the steps 1-10 to define engagement policies for the other actions. Use the information in the following tables:

Caution: For the Rewards, Rewards Plus, and Premier Rewards cards, you have to set their availability to Always as they were a part of a bulk import and were set to Never, which is the recommended way.

Action

Type

Expression

Standard & Rewards

Eligibility

RelationshipLengthDays <= 90

Rewards Plus & Premier Rewards

Suitability

IsFinanciallyVulnerable = false

Note: For the Rewards Plus and Premier Rewards cards, use suitability rules for the engagement policy.

- On the Engagement policy tab of Next-Best-Action Designer, click Actions > Refresh to view the action-level engagement policy type added

5 Verify that customers Troy and Barbara get the right offers per their profiles

- On the exercise system landing page, click U+ Bank to open the website.

- On the main page of the website, in the upper right, click Log in to log in as a customer.

- Log in as Troy, and then log out.

- Log in as Barbara.

- Verify that both Troy and Barbara see the correct offer based on the defined engagement policy based on the following tables.

Customer

Is in Collections

Debt-to-Income ratio

Age

RelationshipLengthDays

NumCreditCardAccount

isFinanciallyVulnerable

Troy

false

45

26

88

0

True

Barbara

false

35

32

364

0

False

Customer

Standard

Rewards

Rewards Plus

Premier Rewards

Troy

Y

Y

Barbara

Y

Y

This Challenge is to practice what you learned in the following Module:

Available in the following mission:

If you are having problems with your training, please review the Pega Academy Support FAQs.

Want to help us improve this content?