Exploring decisions in Customer Decision Hub

4 Tasks

10 mins

Scenario

U+ Bank uses Pega Customer Decision Hub™ to decide which one of four credit card offers to show in a web banner when a customer logs in to the U+ Bank website. Customer Decision Hub determines the offer with the highest priority based on engagement policies and AI that calculates the likelihood that the customer is interested in the offer. The business team has defined the engagement policies in Next-Best-Action designer. Some criteria apply to the entire credit card group, and some apply to specific actions.

| Action | Type | Condition: Customer... |

|---|---|---|

|

All credit cards |

Eligibility |

is at least 18 years old or older |

|

All credit cards |

Applicability |

does not have a credit card |

|

Standard & Rewards |

Eligibility |

has been a customer for a maximum of 90 days |

|

Rewards Plus & Premier Rewards |

Suitability |

Is not financially vulnerable |

Use the following credentials to log in to the exercise system:

| Role | User name | Password |

|---|---|---|

| Data Scientist | DataScientist | rules |

Your assignment consists of the following tasks:

Task 1: Generate a customer interaction on the U+Bank website

Log in as the customer Barbara, take note of the offer she receives, and inspect the offer details.

Task 2: Review the engagement rules in Next-Best-Action Designer

In Next-Best-Action Designer, explore the U+ Bank engagement policies for the credit card offer that Barbara received on the website.

Relevant customer fields:

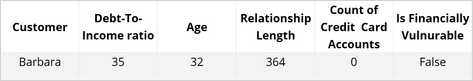

| Customer | Debt-To-Income ratio | Age | Relationship Length | Count of Credit Card Accounts | Is Financially Vulnerable |

|---|---|---|---|---|---|

|

Barbara |

35 |

32 |

364 |

0 |

False |

Task 3: Confirm that propensity is active in arbitration

In the Arbitration section of Next-Best-Action Designer, confirm that propensity is active to ensure that the arbitration process uses AI to select the top action.

Task 4: Inspect the profile of customer Barbara

In Customer Profile Viewer, make a Next-Best-Action decision for Barbara, and review the customer fields that are the most influential predictors that the AI uses to calculate propensities for Barbara.

Challenge Walkthrough

Detailed Tasks

1 Generate a customer interaction on the U+Bank website.

- On the exercise system landing page, click U+ Bank to open the website.

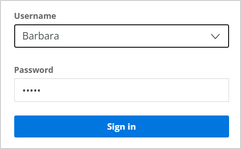

- On the main page of the website, in the upper-right corner, click Log in to log in as a customer:

- In the Username field, select Barbara.

- Click Sign in to log in as Barbara.

- Observe that either the Rewards Plus card or the Premier Rewards card offer is displayed in the web banner, but do not click on the offer.

- Click the Polaris icon on the web banner to inspect the details of the offer.

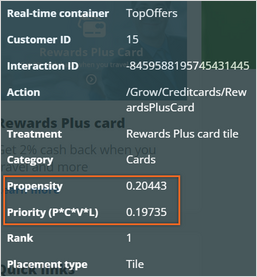

- Inspect the Propensity value that the AI calculates and the Priority value that Customer Decision Hub uses to determine the top action.

- In the upper-right corner, click the profile image, and then select Log out.

2 Review the engagement rules in Next-Best-Action Designer

- On the exercise system landing page, click Pega CRM suite to log in to Customer Decision Hub.

- Log in to Customer Decision Hub as a Data Scientist:

- In the User name field, enter DataScientist.

- In the Password field, enter rules.

- In the navigation pane of Customer Decision Hub, click Next-Best-Action > Designer to open Next-Best-Action Designer.

- In Next-Best-Action Designer, click Engagement policy.

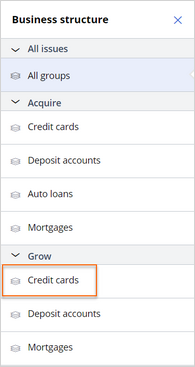

- In the Business structure area, in the Grow section, click Credit cards issue to view the engagement policy for the group.

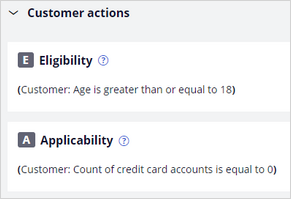

- Expand Customer actions, and then inspect the eligibility and applicability requirements of the Credit cards group.

- Confirm that Barbara meets all criteria.

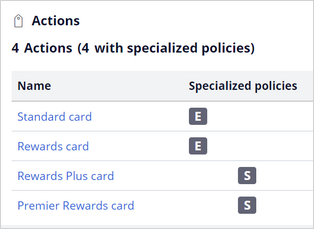

Relevant customer fields: - In the Actions section, confirm that four actions are configured with specialized policies.

- In the Actions section, click the card offer that Barbara received on the U+ Bank website to see the action details.

- In the action form, click the Engagement Policy tab:

- In the Eligibility section, in the Inherited from condition, confirm that the group level eligibility rule for customer actions is Age is greater than or equal to 18.

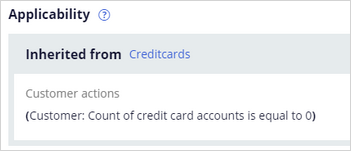

- In the Applicability section, in the Inherited from condition, confirm that the group-level applicability rule for customer actions is Count of Credit Card accounts is equal to zero, which means that the customer does not have an active credit card.

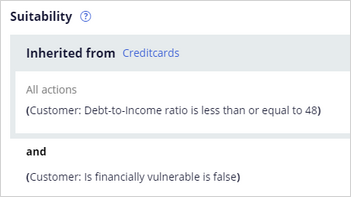

- In the Suitability section, in the Inherited from condition, confirm that the group level suitability rule for customer actions is Debt-to-Income ratio is less than or equal to 48 and that the action level eligibility rule is Is financially vulnerable is false.

- Confirm that Barbara meets all eligibility, applicability, and suitability criteria for this credit card offer.

Relevant customer fields:Customer Debt-To-Income ratio Age Relationship Length Count of Credit Card Accounts Is Financially Vulnerable Barbara

35

32

364

0

False

- Close the action form to return to Next-Best-Action Designer.

3 Confirm that propensity is active in arbitration

- In the Next-Best-Action Designer, click the Arbitration tab to inspect the arbitration formula.

- Verify that the final priority is determined using Propensity and Context weighting.

4 Inspect the profile of customer Barbara

- In the upper-right corner of Customer Decision Hub, click the Reports icon, and then click Customer Profile Viewer.

- In the Customer Profile Viewer window, in the Customer ID field, enter 15, which is Barbara's customer ID, and then click View.

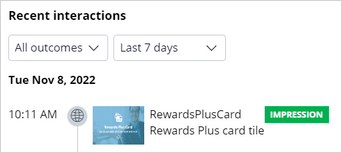

- In the Recent interactions section, confirm that Barbara received a credit card offer.

Note: This reflects that Barbara logged into the U+Bank website in task 1.

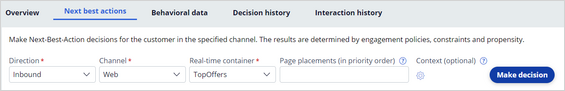

- In Barbara's profile, click the Next best actions tab, and then set up the details to make a decision for Barbara:

- In the Direction list, select Inbound.

- In the Channel list, select Web.

- In the Real-time container list, select TopOffers, and then click Make decision.

- Click Density > Full Content to display the full action names.

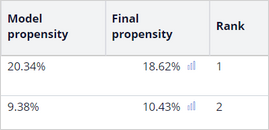

- Verify that Barbara is eligible for the Rewards Plus card and the Premier Rewards card. The ranking of the cards depends on the priority value.

- Click Default > Explain propensity.

- Notice that the Model propensity values and the Final propensity values are not identical.

Note: When models are immature, the system adds noise to the propensity. As the number of responses increases over time, the noise decreases, and the final propensity becomes closer to the propensity value of the raw model.

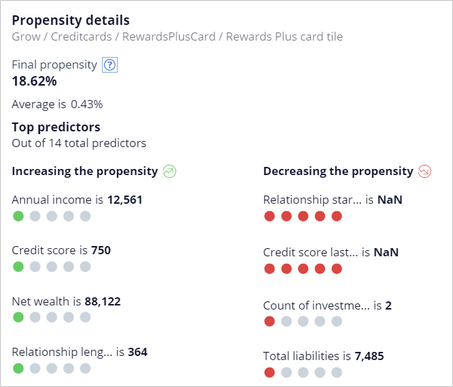

- In the row for the card with the highest rank, in the Final propensity column, click the Graph icon to view the propensity details.

- In the Propensity details window, take note of the following information:

- The value in the Final propensity section.

- The predictors that contribute to the increase (in green) and decrease (in red) of the propensity for Barbara.

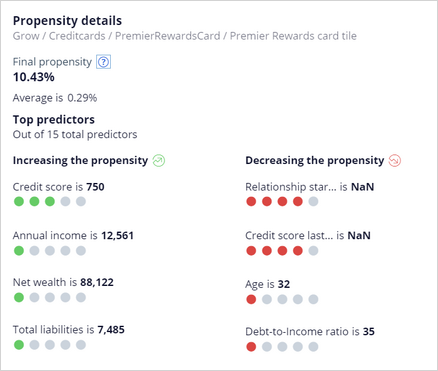

- In the row for the second card, in the Final propensity column, click the Graph icon to view the propensity details.

- In the Propensity details window, confirm the following information:

- The lower value of the Final propensity section when compared to the higher ranking card.

- The predictors that contribute to the increase and decrease in the propensity for this offer to Barbara.

This Challenge is to practice what you learned in the following Module:

Available in the following mission:

If you are having problems with your training, please review the Pega Academy Support FAQs.

Want to help us improve this content?