Defining Customer Journeys

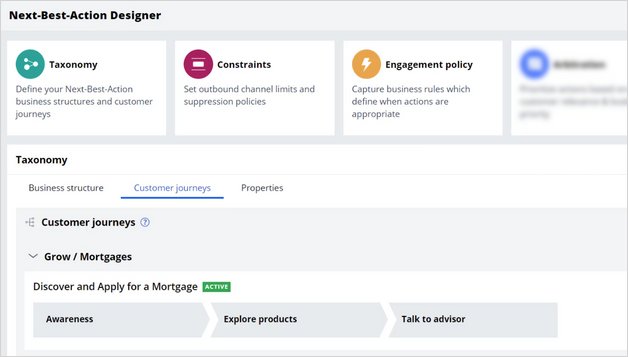

Define and maintain customer journeys through the Next-Best-Action Designer to let the NBA Designers shape and monitor the experience that customers have with an entire process, not just one action or treatment. For example, the customer journey can guide a customer to first gain awareness of a product, see the offers themselves, and then finally speak to a representative. This sequential offer structure creates a streamlined and more thoughtful approach to presenting a product. Other examples of such processes include applying for a new credit card, refinancing a loan, or onboarding a new customer.

Video

Transcript

This video demonstrates how to define and assemble a fully functioning customer journey in Customer Decision Hub.

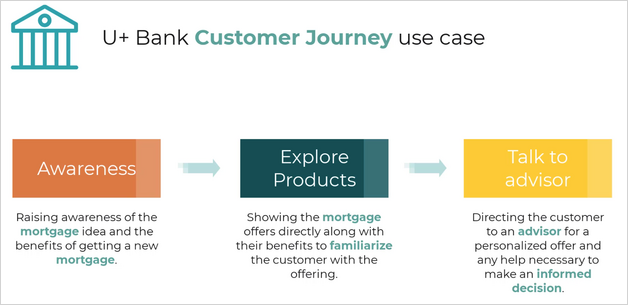

U+ Bank wants to use customer journeys for its mortgage offering. The bank plans to first make customers aware of applying for a mortgage and its benefits. After the customer shows interest, U+ Bank wants to enable customers to explore some of the mortgage offers directly. Finally, U+ Bank wants to connect customers to an advisor to make a personalized offer and to ensure that customers make an informed decision on their mortgage. By using customer journeys, U+ Bank puts actions and treatments into stages in a sequential format that guides customers toward mutually beneficial outcomes.

To implement this use case, you first define the customer journey on the Taxonomy tab of Next-Best-Action Designer.

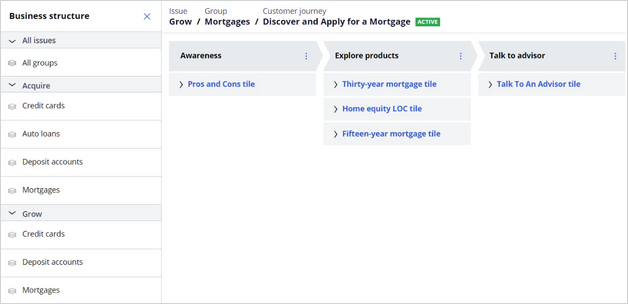

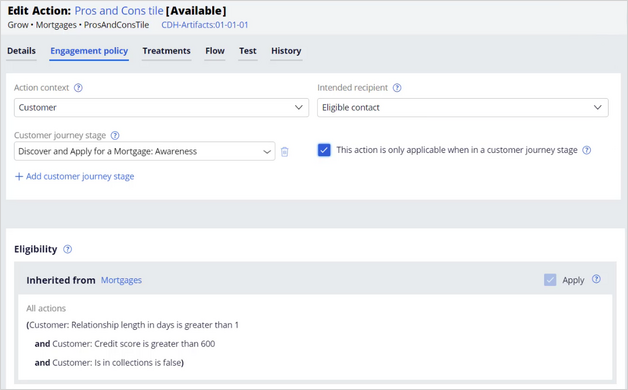

On the Taxonomy tab, you name the customer journey, and then specify the business issue and group to which your customer journey belongs. This designation is important because customer journeys inherit the engagement policies of the business issue and group that they occupy. In the following example, the actions that are assigned to this journey inherit the engagement policies of the Grow business issue and Mortgages group.

After you create your journey, you can add stages to it. At this point, you define only the names of the stages and the sequence in which the customer progresses through them. In this example, you create stages that represent the three engagement stages with the customer in the process of getting a new mortgage:

- Awareness

- Explore products

- Talk to advisor

After you define the journey and the stages, you then add actions to the corresponding stages. When you add actions to each stage, the application adds all their available treatments. The order in which you add actions to the stage is irrelevant. The AI uses the propensity of the customer to decide which action is the best to display in the stage or out of the stage. The customer journeys do not interfere with the next-best-action paradigm.

U+ Bank wants to ensure that the application displays a given action to a customer only as part of a journey. Configure this in the action itself to prevent it from displaying as a standalone action.

Next, you set the entry criteria. Entry criteria determine which conditions customers must satisfy to move to the next stage. Each stage can have its own criteria that check for various business conditions to match. For example, criteria can check the following conditions:

- The maturity of the customer relationship with U+ Bank.

- The level of interest that a customer shows in a specific category of products.

- Whether it is appropriate to connect customers with an advisor.

To implement entry criteria, use simple conditions that apply properties or use furthermore complex conditions that apply decision strategies.

For the Discover and Apply for a Mortgage journey, U+ Bank decides to use the following conditions:

The Awareness stage is relevant for customers that currently are not part of this journey.

The Explore products stage is relevant only if customers engage in the Awareness stage.

The Talk to advisor stage is relevant only if customers engage with an offer in the Explore products stage.

Start with the first stage, Awareness. U+ Bank wants to configure the Awareness stage to ensure that customers qualify because the goal of this stage is to bring attention to the mortgage offer. As a result, you leave the entry criteria for this stage blank. Customers who qualify for actions from the Mortgages group are in this stage of the journey.

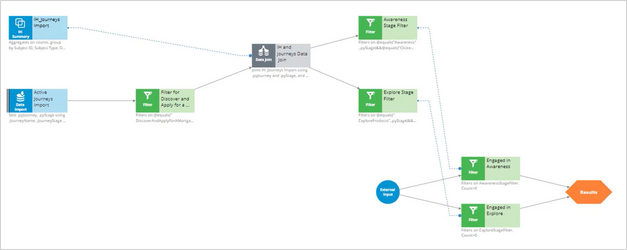

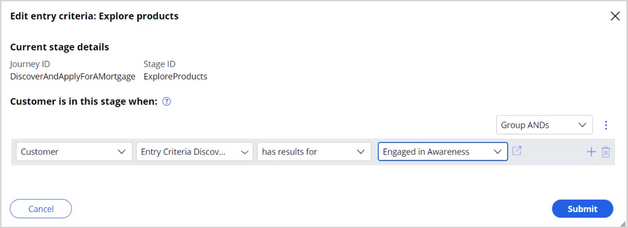

Next, set the entry criteria for the two remaining stages by using the decision strategy. The strategy that you use here is customized for this journey and is not a part of the out-of-the-box experience.

The entry criteria expression uses two filter components:

- Engaged in Awareness

- Engaged in Explore

Therefore, they have to be connected to the Results component.

The Engaged in Awareness filter component outputs a record if the customer clicks at least one action from the Awareness stage. To implement it, use an interaction history summary component, which imports journeys and stages that a customer has ever initiated. This data is joined with the current journey data to find out the current active stages of this journey. Next, you find out if any click events are registered in the awareness stage. Finally, the U+ Bank definition of engaged in awareness: if at least one or more click events are detected on any action from the awareness stage. The Engaged in explore condition follows a similar pattern. The strategy can implement more complex conditions, but for this scenario, U+ Bank uses this strategy to define its customer engagement in a stage.

With this decision strategy, in the Explore products stage, you set the condition to check if the strategy has results for Engaged in Awareness. The condition determines whether the customer engaged positively with one of the offers in the Awareness stage, and the strategy returns a result for the Engaged in Awareness filter.

Next, you specify an analogous condition for the Talk to advisor stage to check whether the customer engages positively with one of the offers in the Explore products stage. After you set up these entry criteria and save them, you can test the customer journey.

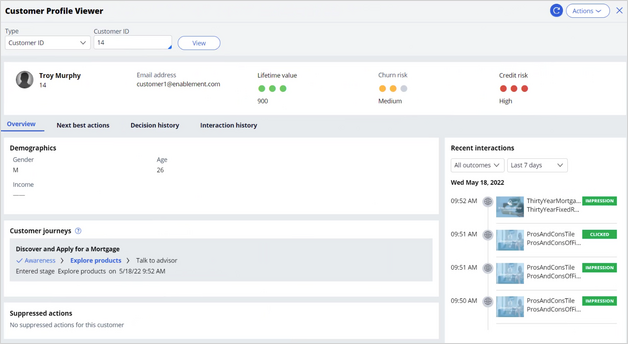

Test the first customer journey for U+ Bank on the bank website. You can follow the progress of the U+ customers in the Customer Profile Viewer, as shown:

Follow Troy as he first logs in to the U+ Bank website and begins to engage with the Discover and Apply for a Mortgage customer journey. Troy sees the first web tile for one of the Awareness stage actions. This triggers the recording of the impression. As you can see in the Customer journey section of the Customer Profile Viewer, Troy is now in the Awareness stage.

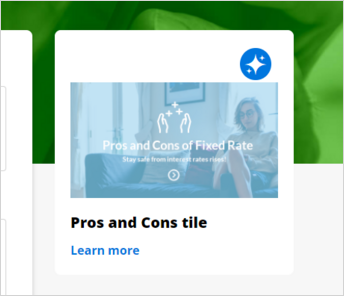

Troy clicks the banner, meaning he is engaging the awareness stage. This action makes Troy eligible for the next stage of the journey. As a result, the next time he logs in, he can see a mortgages action, as prioritized by the AI, from the possible actions from the current Explore stage. You can see the results of this interaction in Customer Profile Viewer that shows that Troy is now in the Explore Products stage.

Later, Troy logs back into the U+ Bank website and shows interest by clicking the offer. As a result, he advances to the Talk to advisor stage and the next time he logs in, he sees the Talk to Advisor tile. You can see the progress in Customer Profile Viewer.

Troy moves through the entire journey and can now make an informed decision on which mortgage he wants to purchase after the advisor contacts him. You see now how the underlying decision strategy works in the background for entry criteria to trigger the customer progress through the Discover and Apply for a Mortgage customer journey.

You have reached the end of this video. What did it show you?

- How to define and assemble a customer journey.

- How to set stage entry criteria.

- How to test customer journeys.

- How to monitor customer journey progress in Customer Profile Viewer.

This Topic is available in the following Modules:

If you are having problems with your training, please review the Pega Academy Support FAQs.

Want to help us improve this content?