Due diligence orchestration mode

Every financial institution has a target operating model, so the way in which financial institutions orchestrate their work varies considerably. Target operating models ranges in complexity based on some of the following factors:

- Financial segments served: One or more segments, such as Retail, Commercial, Wealth, each of which has different complexities.

- Geographic reach: Single jurisdiction, regional or truly global.

- Product offerings: Certain products such as derivatives attract more regulatory due diligence.

The operating models change over time as operations evolve. To meet the financial institution's needs the Pega CLM and KYC application provides preconfigured modes of Due Diligence orchestration. Each mode offers a differing number of cases, questionnaires that each of those cases present, and a different operating model that drives the distribution of the work.

Due diligence orchestration modes

Due diligence orchestration has three preconfigured modes available for use: Standard, Intermediate, and Simplified.

Mode 1: Standard

The Standard mode is suitable for businesses that need to handle the highest levels of complexity to serve customers. Such businesses are typically large global operators that serve a wide array of customers in market segments, such as Corporate and Investment Banking. The mix of products that the business offers is typically heavily regulated.

In the following image, click the + icons to learn more about the Standard mode.

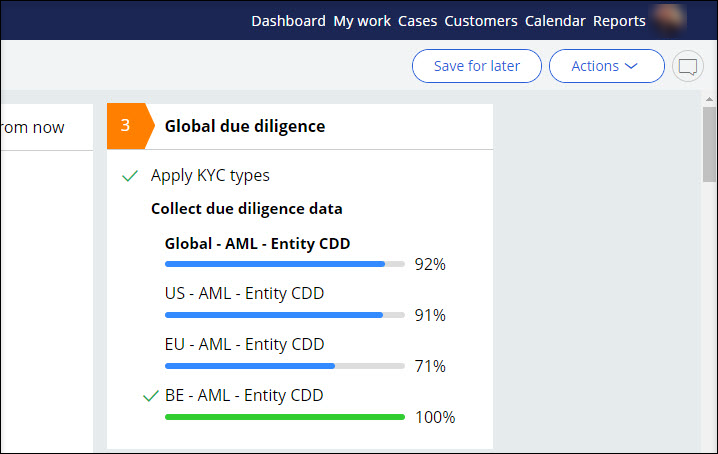

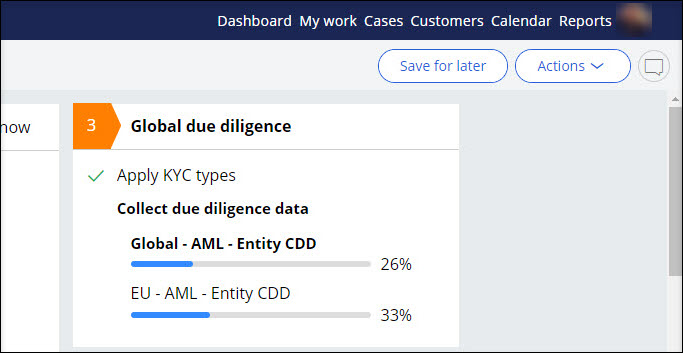

In the Standard mode, the application generates a Global KYC case for global and regional AML questionnaires. Separate Local KYC cases that are created show Local AML questionnaires for each jurisdiction of the product. The following figure shows a Global KYC case which only displays the global (Global - AML - Entity CDD) and regional (EU - AML - Entity CDD) questionnaires. For example, the Local AML questionnaires for the US and Belgium are in separate Local KYC cases.

The cases outlined in this mode are routed through the highest number of departments, including Global Due Diligence, FATCA, and CRS, as well as separate departments for each Local AML and Product regulation jurisdiction.

Mode 2: Intermediate

The Intermediate mode is best suited for businesses with lesser complexity needs than the Standard mode but both still run large operations. An intermediate business type may focus on a single region but still maintain a reasonable number of jurisdictions. The product offerings are typically reduced but still include some regulated products.

In the following image, click the + icons to learn more about the Intermediate mode.

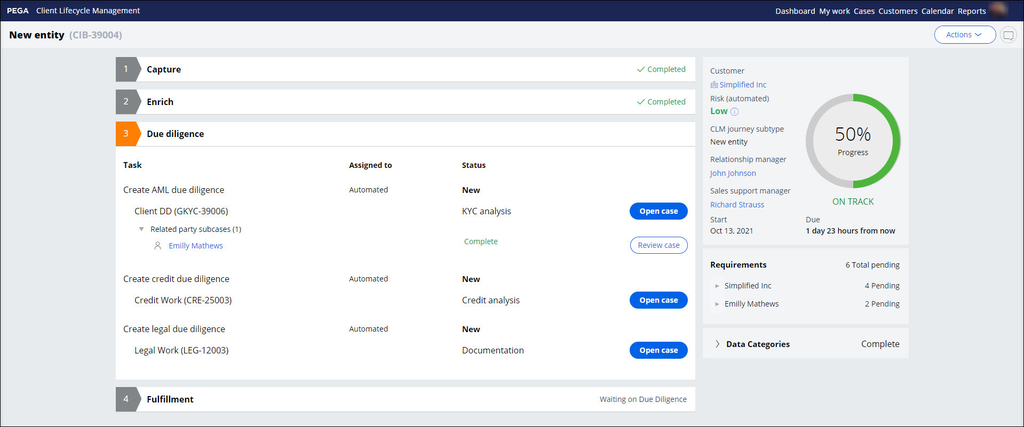

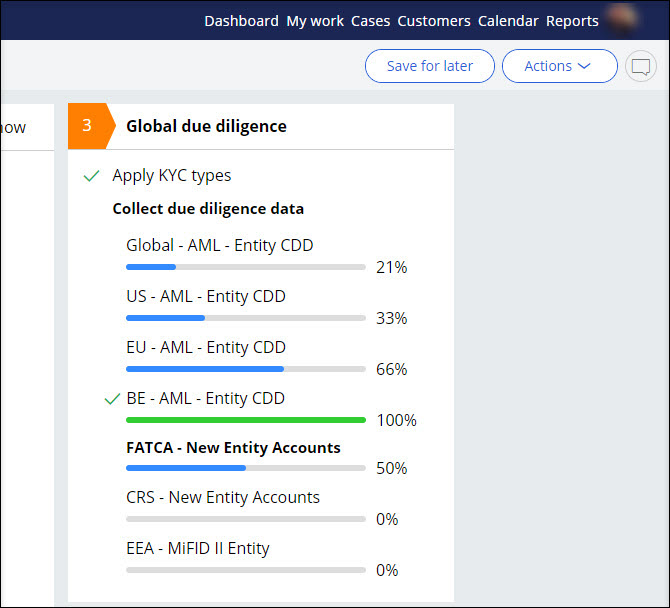

In the Intermediate mode, a single Global KYC case displays all AML questionnaires for the customer. In the following figure, Local AML questionnaires for the US (US - AML - Entity CDD) and Belgium (BE - AML - Entity CDD) are presented together in the Global due diligence case.

The cases that are outlined in the Intermediate mode are routed through a smaller number of departments than the Standard mode. For example, all AML due diligence work is routed through a single AML department. The Regulatory and Tax departments handle their own activities.

Mode 3: Simplified

The Simplified mode enables a centralized approach to orchestrate the due diligence work of organizations, such as those focused on a smaller geographic area with a simpler product mix.

In the following example, there is a single case to cover all AML, Product Regulatory, and Tax questionnaires for the customer. There is one subcase for each applicable related party for handling the required Global AML questionnaires.

All questionnaires for the customer are displayed in the main GKYC case.

For the Simplified mode, a single department handles all AML, Product, and Tax Regulatory work.

Due diligence orchestration mode changes

No matter how slowly or quickly, all businesses change over time. There can be an expansion to a new region or a reduction in the number of jurisdictions served. Certain business functions may consolidate centrally or spread out to multiple regions.

As a target operating model evolves, the systems that manage the work must also easily adapt. Failure to adapt to such changes can lead to large inefficiencies and jeopardize business strategies. The Pega CLM and KYC application meets such a need for flexibility by aligning with an initial target operating model and then accommodating changes over time without any deep impact on the underlying system and ongoing work.

The mode of due diligence orchestration is easily configurable. By default, the system applies a single-mode across the whole application. However, you can configure that mode to allow different modes for specific business use cases. For example, you can set the Standard mode for one type of customer and Simplified for another.

The configuration brings a powerful level of flexibility in how the due diligence activities of different business use cases can vary in their orchestration.

When the orchestration mode changes, all new customer journeys are orchestrated based on the new mode. Any customer journeys that are in process before the change in orchestration mode are completed through the previous orchestration mode.

Check your knowledge with the following interaction.

This Topic is available in the following Modules:

If you are having problems with your training, please review the Pega Academy Support FAQs.

Want to help us improve this content?