Predicting case completion

Introduction

Pega Process AI™ can help to distinguish regular from complex claims. Complex claims often escalate into a lengthy process, which is costly and leads to a bad customer experience. The distinction lets you detect these claims early and address them at once.

Learn how to create a prediction that aims to identify cases that are likely to miss their deadlines and route them to a senior employee to handle them more efficiently and improve the customer experience.

Video

Transcript

This demo shows you how to use adaptive models to predict successful case completion.

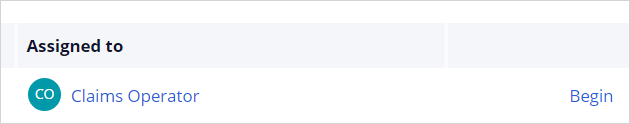

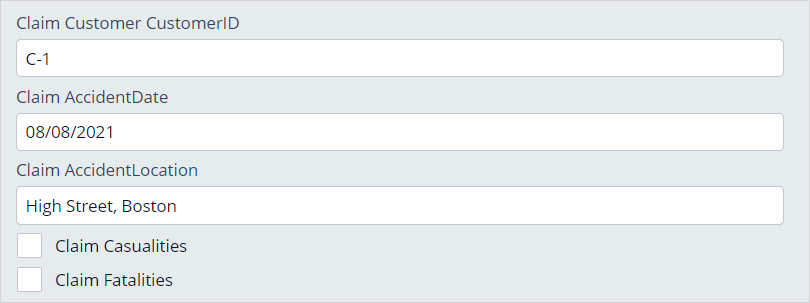

U+ Insurance uses Pega Platform™ for case management. An incoming car insurance claim is routed to a claims operator, who approves or rejects the claim to resolve the case.

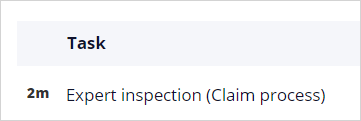

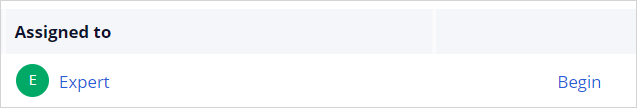

A case is escalated to an expert when the claim is not completed in the allotted time for regular processing.

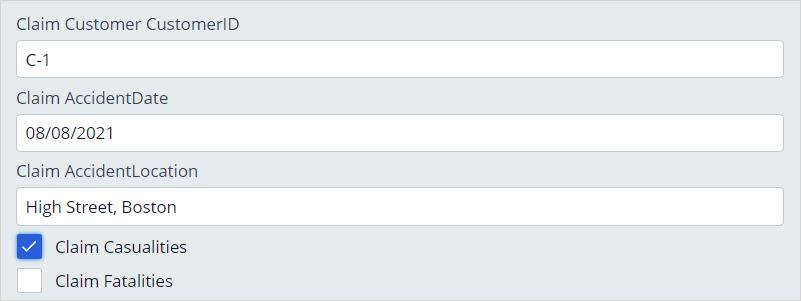

Claims that involve casualties can be very complex and are always routed to an expert instead of a regular claims operator as a precaution.

However, claims that involve casualties can often be resolved on time in the regular claims process. The experts consequently spend valuable time on relatively simple claims.

The primary stages of the Car Insurance claim case type comprise the regular claims process that leads to disbursement of the claimed amount. The alternative stages represent other process resolutions, such as the rejection of the claim.

Process AI can help optimize the process by predicting the likelihood that a case is resolved before the deadline in the regular workflow and otherwise, route it to an expert irrespective of the cause of the complexity of the claim. This optimization requires a data scientist to create a case management prediction that calculates the propensity of whether the case is complex.

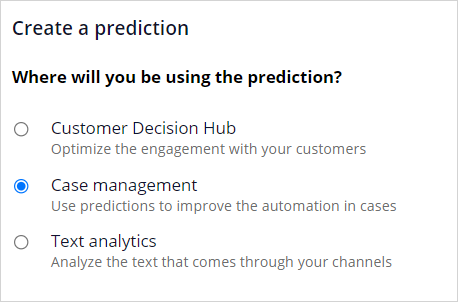

Process AI offers a wizard to create case completion predictions.

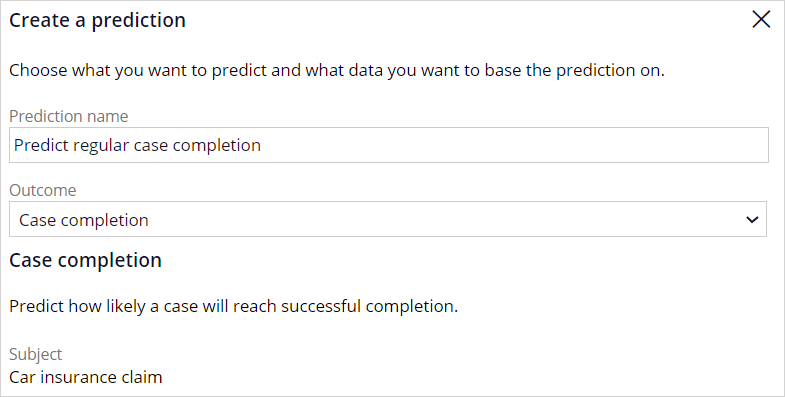

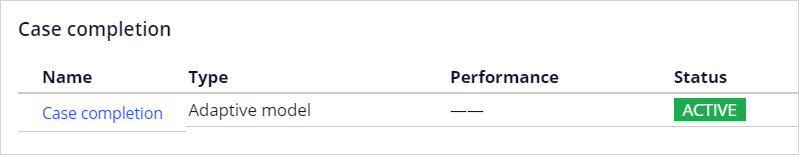

The subject of the prediction is the insurance claim. You do not need historical data, as the prediction is self-learning and uses adaptive models.

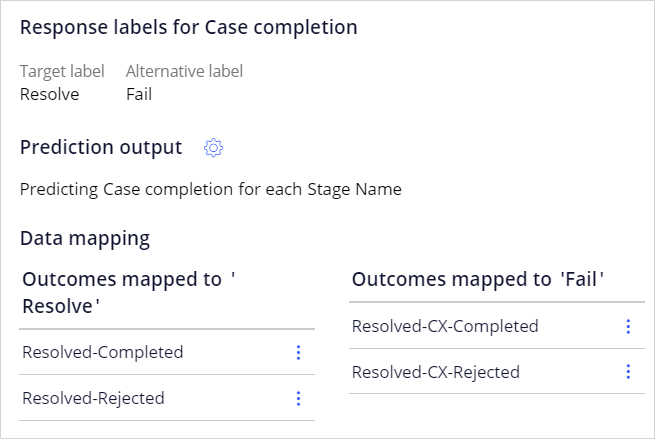

The target response label for the prediction is Resolve. It denotes a claim that is approved or rejected in the regular process. The alternative label, Fail, maps to resolution of a claim by an expert. The CX in the outcome names denotes a complex claim.

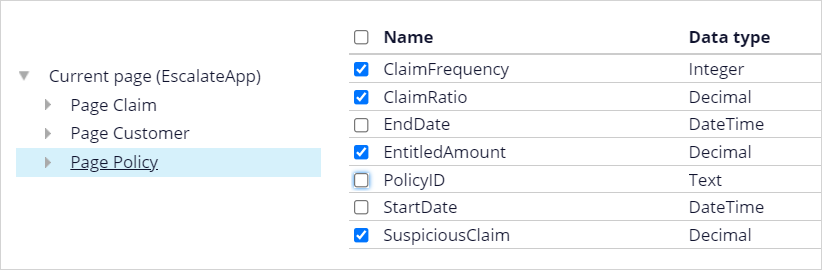

A best practice is to deselect fields that have no predictive value or are not allowed. Also, use a date field only if it reflects a time interval and not a definite date. An adaptive model drives the prediction.

A best practice is to include many unrelated fields, including the claim properties. Casualties is one of the fields, and AI determines how well this predictor performs in predicting a complex case. Also include customer properties and behavior data such as the claim frequency of the customer.

The adaptive model learns from previous cases and automatically activates predictors that perform above a threshold and deactivates predictors when their performance drops over time. The prediction is ready to be implemented in the Car Insurance claim case type by an application developer.

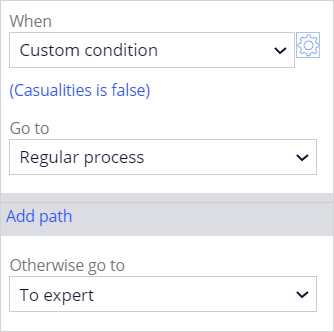

In the Claims process stage of the case type, a decision component routes cases to a claims operator or, when the claim involved casualties, to an expert.

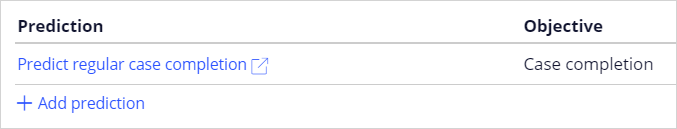

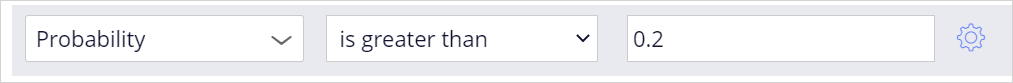

The condition requires an edit to meet the business requirement that the routing decision is based on the propensity that is calculated by the case outcome prediction. To use a prediction in a case type, add it to the settings.

To qualify for the regular claims process, the propensity to resolve the claim without the involvement of an expert exceeds a threshold.

When a claims operator handles a claim the case status is Resolved-Completed or Resolved-Rejected, and the outcome of the case maps to the target label for the prediction. When a complex claim misses the deadline and is reassigned to an expert the outcome of the case maps to the alternative label for the prediction.

A claim with a low propensity to be resolved successfully in the regular workflow is immediately routed to an expert. The claim is routed to the regular workflow when the expert assesses the claim and does not consider it a complex case. This reassignment allows the adaptive model to learn from cases that are incorrectly routed to the expert.

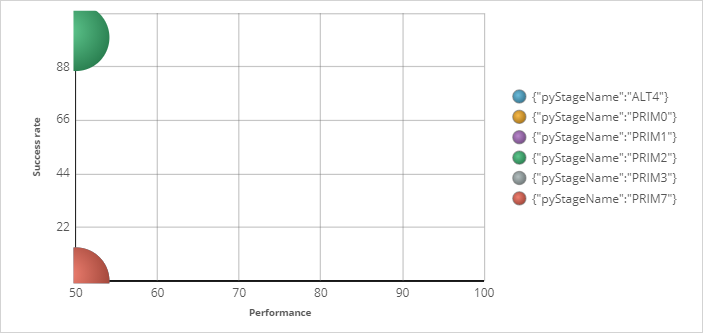

An adaptive model is created for each primary and alternative stage in the case type. A decision request in a stage uses the model that is specific to that stage to calculate the propensity.

The models have no predictive power yet but self-optimize as more case outcomes are captured over time.

This demo has concluded. What did it show you?

- How to create a case completion prediction.

- How to implement a case completion prediction to improve efficiency.

This Topic is available in the following Modules:

If you are having problems with your training, please review the Pega Academy Support FAQs.

Want to help us improve this content?