Building a scorecard to calculate the credit score

3 Tasks

10 mins

Scenario

U+ Bank is cross-selling on the web by showing various credit cards to customers. Because of each card's credit limits, credit cards are unsuitable for customers if their credit score is less than 300 due to the likelihood of default.

The credit score value is available in the data model, and external processes populate the value in a nightly batch. However, a credit score is not computed for every customer.

As a result, the business wants a scorecard that computes a customer’s credit score in case the score is not available.

Use the following credentials to log in to the exercise system:

|

Role |

User name |

Password |

|

Decisioning Analyst |

CDHAnalyst |

rules |

Your assignment consists of the following tasks:

Task 1: Create a scorecard, Determine Credit Score, with exact specifications

Customer Credit Card indicator

Assign a score of 100 if the customer has any card with U+. Otherwise, assign a score of 0.

Note: For this condition, use the HasCards property. The value “Y” indicates the customer does have a card with U+.

Customer Income

Split the values for yearly income into three ranges, and assign scores to each range as follows:

|

Condition |

Score |

|

<=10000 |

50 |

|

<=40000 |

100 |

|

<=75000 |

150 |

|

Otherwise |

200 |

Note: Use the Income property, which shows monthly income, to create an expression that determines yearly income.

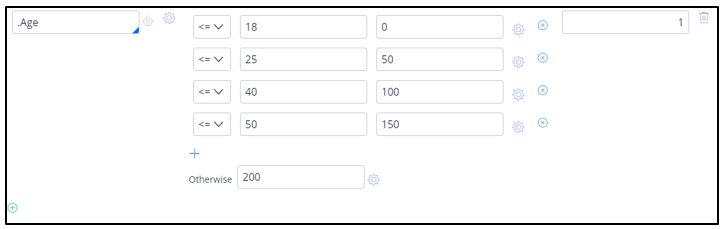

Customer Age

Split the values for age into four ranges, and assign scores to the age ranges as follows:

|

Condition |

Score |

|

<=18 |

0 |

|

<=25 |

50 |

|

<=40 |

100 |

|

<=50 |

150 |

|

Otherwise |

200 |

Note: For this requirement, use the Age property.

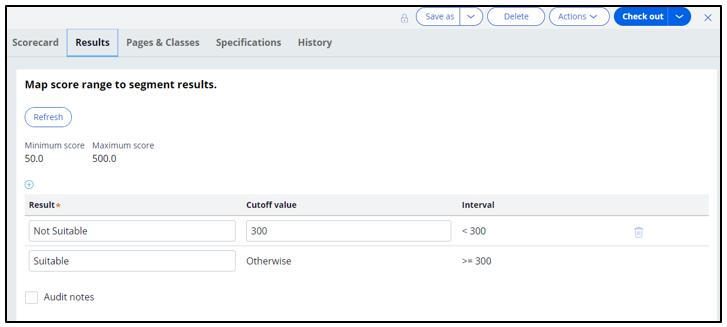

Task 2: Configure the scorecard result to Not suitable and Suitable

The scorecard should output Not Suitable if the credit score is less than 300 and Suitable if the score is equal to or higher than 300.

Task 3: Confirm your work

Verify the scorecards for customers Troy and Robert.

Challenge Walkthrough

Detailed Tasks

1 Create a scorecard Determine Credit Score with exact specifications

- Log in as Decisioning Analyst with User name CDHAnalyst and password rules.

- In the navigation pane on the left, click Intelligence > Scorecards to open the Scorecards landing page.

- In the upper right, click Create.

- On the Create Scorecard landing page, in the text box, enter Determine Credit Score.

- In the Development branch list, if exists, select [No branch]

- In the upper right, click Create and open to open the Scorecard rule form.

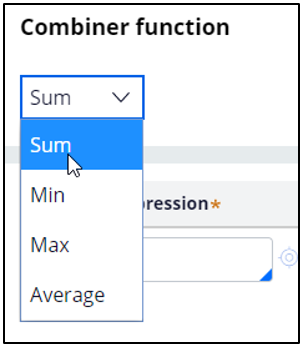

- In the rule form, in the Combiner function list, select Sum to calculate the total score (if Sum is not the default.)

- In the Predictor expression field, enter or select .HasCards and define the condition for the customer CreditCard indicator as follows:

- Condition = Y and Score = 100

- Otherwise = 0

- Under the Condition field, click the Add icon to add another predictor expression.

- In the Predictor expression field, enter or select .Income * 12.

Note: This property has a monthly income, and you need the yearly income. Therefore use an expression to determine the yearly income.

- Complete the row with the following conditions:

- Condition <= 10000 and Score = 50

- Condition <= 40000 and Score = 100

- Condition <= 75000 and Score = 150

- Otherwise = 200

- Under the Condition field, click the Add icon to add another predictor expression.

- In the Predictor expression field, enter or select .Age, and then define the conditions and assign scores to the customer Age ranges as follows:

- Condition <= 18 and Score = 0

- Condition <= 25 and Score = 50

- Condition <= 40 and Score = 100

- Condition <= 50 and Score = 150

- Otherwise = 200

2 Configure the scorecard result to Not suitable and Suitable

- In the Scorecard rule form, click the Results tab to enter the results of the scorecard.

- In the first row, in the Result field, enter Not Suitable.

- In the Cutoff value field, enter 300.

- In the second row, in the Result field, enter Suitable.

- In the upper right, click Save to save the changes.

- Click the Close icon to the scorecard.

- Click the Refresh icon to refresh the Scorecard landing page and see the newly added scorecard.

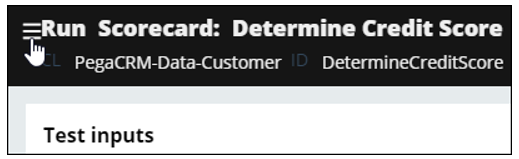

3 Confirm your work

- On the Scorecard landing page, click DetermineCreditScore to open the card.

- In the upper-right corner, click Actions > Run to compute customer credit score.

- In the upper left, click the More icon to expand the Run window.

- In the Thread list, select DetermineCreditScore.

- Select the Apply data transform check box.

- In the Data transform field, enter or select Troy.

- In the upper right, click Run.

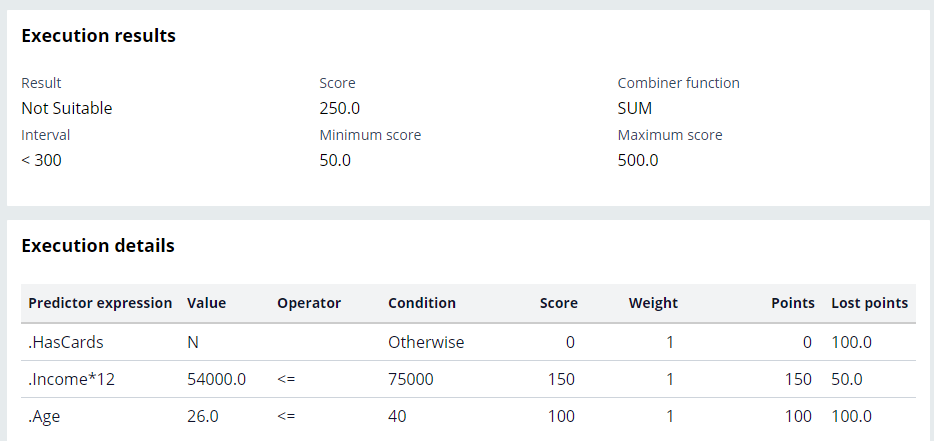

Troy gets a score of 250, so he is not suitable for a credit card.

- Repeat steps 4-7 for Robert.

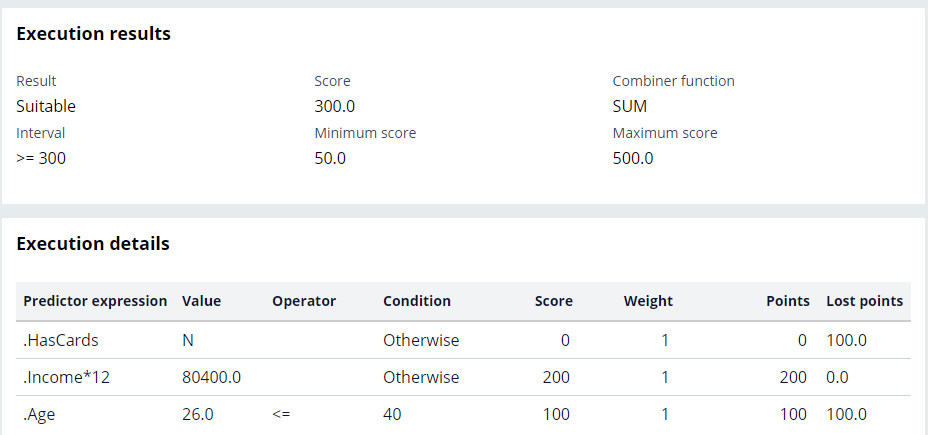

Robert gets a score of 300, so he is suitable for a credit card.

Available in the following mission:

If you are having problems with your training, please review the Pega Academy Support FAQs.

Want to help us improve this content?