Building a scorecard to calculate the credit score

2 Tasks

10 mins

Scenario

U+ Bank is cross-selling on the web by showing various credit cards to customers. Because of the limit for each card, credit cards are unsuitable for customers if their credit score is less than 600 due to the likelihood of default.

The credit score value is available in the data model, and external processes populate the value in a nightly batch. However, a credit score is not computed for every customer.

As a result, the business wants a scorecard that computes a customer's credit score if the score is not available.

Use the following credentials to log in to the exercise system:

| Role | User name | Password |

|---|---|---|

| Decisioning Architect | DecisioningArchitect | rules |

Your assignment consists of the following tasks:

Task 1: Create a scorecard, Determine Credit Score, with exact specifications

- Customer Financial Vulnerability indicator

Assign a score of 0 if the customer is financially vulnerable. Otherwise, assign a score of 300.

Note: For this condition, use the IsFinanciallyVulnerable property. The value True indicates the customer is financially vulnerable.

- Customer Annual Income

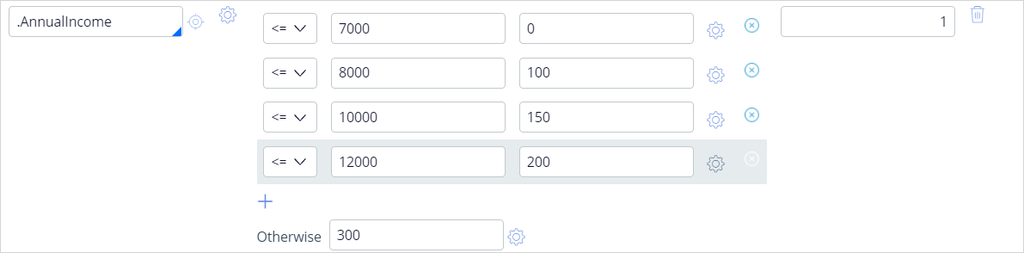

Split the values for yearly income into four ranges, and assign scores to each range as shown in the following table:

|

Condition |

Score |

|

<=7000 |

0 |

|

<=8000 |

100 |

|

<=10000 |

150 |

|

<=12000 |

200 |

|

Otherwise |

300 |

Note: Use the AnnualIncome property for the ranges.

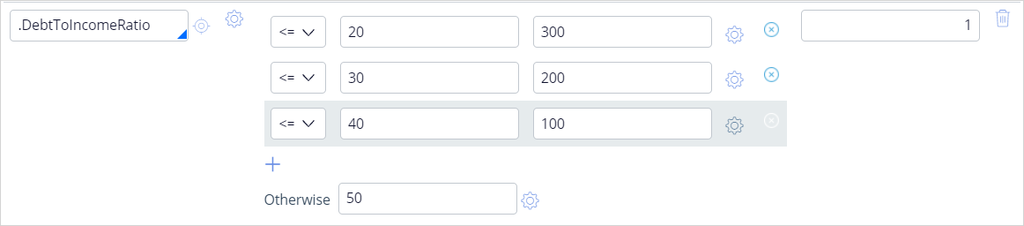

- Customer DebtToIncomeRatio

Split the values for Debt To Income Ratio into three ranges, and assign scores to the ranges as shown in the following table:

|

Condition |

Score |

|

<=20 |

300 |

|

<=30 |

200 |

|

<=40 |

100 |

|

Otherwise |

50 |

Note: For this requirement, use the DebtToIncomeRatio property.

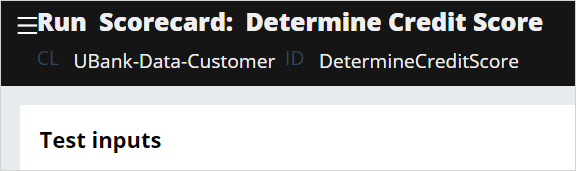

Task 2: Configure the scorecard result to Not suitable and Suitable

The scorecard outputs Not Suitable if the credit score is less than 600 and Suitable if the score is equal to or higher than 600.

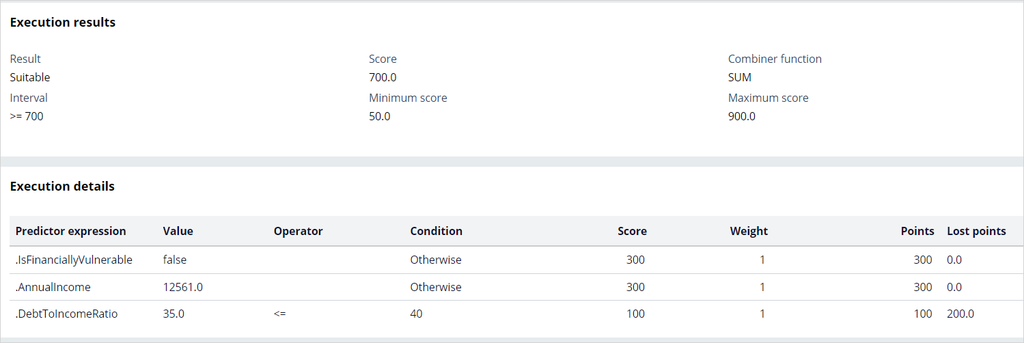

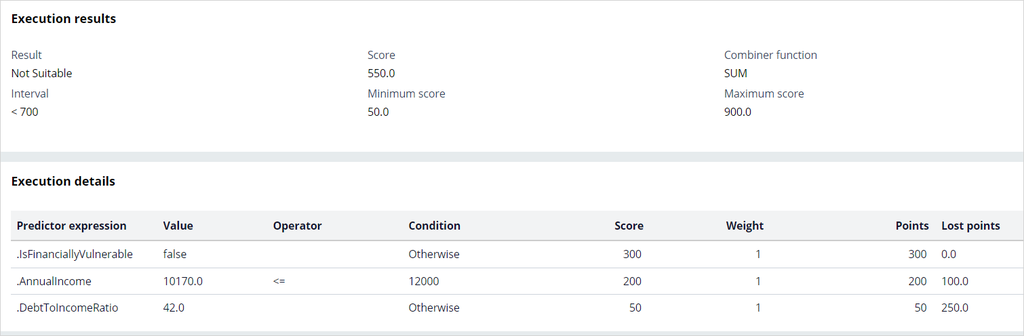

Task 3: Confirm your work

Verify the scorecards for customers Barbara and Robert.

Challenge Walkthrough

Detailed Tasks

1 Create a scorecard Determine Credit Score with exact specifications

- On the exercise system landing page, click Pega CRM suite to log in to Pega Customer Decision Hub™.

- Log in as Decisioning Architect with User name DecisioningArchitect and Password rules.

- In the navigation pane of Customer Decision Hub, click Intelligence > Scorecards to open the Scorecards landing page.

- On the Scorecards landing page, in the upper right, click Create to open the Create Scorecard form.

- On the Create Scorecard landing page, in the Scorecard Record Configuration section, in the text box field, enter Determine Credit Score.

- In the Context section, confirm that the Apply to field autopopulates to UBank-Data-Customer.

- In the upper right, click Create and open to open the rule form of the scorecard.

- On the rule form, on the Scorecard tab, in the Combiner function list, confirm that Sum is selected.

- In the Predictor expression field, enter or select .IsFinanciallyVulnerable, and then define the condition with the following values:

- Condition = True and Score = 0

- Otherwise: Score = 300.

- Click Add to add another predictor expression.

- In the Predictor expression field, enter or select .AnnualIncome, and then define the condition with the values as shown in the following figure:

- Click the Add icon to add another predictor expression.

- In the Predictor expression field, enter or select .DebtToIncomeRatio, and then define the condition with the values as shown in the following figure:

2 Configure the scorecard result to Not suitable and Suitable

- On the scorecard rule form, click the Results tab to see the results of the scorecard.

- In the first row, in the Result field, enter Not Suitable.

- In the Cutoff value field, enter 600.

- In the second row, in the Result field, enter Suitable.

- Click Save to save the changes.

- Close the scorecard.

- On the Scorecard landing page, click the Refresh icon to see the newly added scorecard.

Confirm your work

- On the Scorecard landing page, double-click DetermineCreditScore to open the card.

- In the upper-right corner, click Actions > Run.

- Expand the Run menu.

- In the Thread list, select the DetermineCreditScore card.

- Select the Apply data transform checkbox.

- In the Data transform field, enter or select Barbara.

- In the upper right, click Run.

The values of the properties are populated in the execution details after applying a data transform.Barbara gets a score of 700, so she is suitable for a credit card. - Repeat the steps 4-7 for Robert.

- Robert gets a score of 550, so he is not suitable for a credit card.

This Challenge is to practice what you learned in the following Module:

Available in the following mission:

If you are having problems with your training, please review the Pega Academy Support FAQs.

Want to help us improve this content?