Analyzing simulation results using Scenario Planner

4 Tasks

5 mins

Scenario

U+ Bank is currently cross-selling on the web by showing various credit cards to its customers.

The bank wants to boost two credit card actions by applying a business weight. The bank wants to understand the opportunity cost or gain in using levers to adjust AI prioritization.

Use the following credentials to log in to the exercise system:

|

Role |

User name |

Password |

|---|---|---|

|

Decisioning Analyst |

CDHAnalyst |

rules |

Your assignment consists of the following tasks:

Task 1: Prepare data set for simulation run

Run the PrepareSampledCustomers_REF data flow to prepare the data set for the simulation run.

Note: The Sampled Customers is not available in a persisted store. To initialize the customer data, first, run the PrepareSampledCustomers_REF data flow.

If you already initiated the customer data as part of a previous challenge, you do not need perform Task 2.

If you already initiated the customer data as part of a previous challenge, you do not need perform Task 2.

Task 2: Add business weight to actions

Add a business weight to Standard card and Rewards card actions to manually nudge the offers.

|

Action |

Business Weight |

|---|---|

|

Standard card |

20% |

|

Rewards card |

40% |

Task 3: Create and execute an arbitration audience simulation

Create and execute an audience simulation. Use the Sampled Customers data set as the audience and engagement policy and arbitration as the simulation scope.

Task 4: Analyze the simulation results in Scenario Planner

Analyze the audience simulation with the arbitration in scenario planner to understand the effects of adding business weight to the actions. Answer the following questions.

- What is the effect of applying the business levers? Is there an indication of an opportunity cost or opportunity gain?

- How does the application of business levers affect the percentage of accepts?

- Which actions are traded off if the business levers are applied and what is the volume?

- How many times is the Rewards card sent or presented to customers before and after applying business levers?

- How many customers are likely to accept the Premier Rewards card when the business levers are not applied?

- Which scenario is more profitable for the business?

Challenge Walkthrough

Detailed Tasks

1 Prepare data set for simulation run

- Log in as Decisioning Analyst with username CDHAnalyst and password rules.

- In the navigation pane of Pega Customer Decision Hub, click Data > Data Flows.

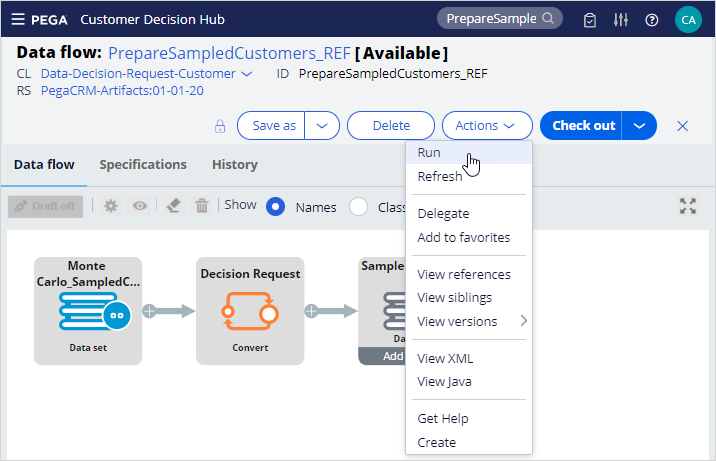

- Search for and then open the PrepareSampledCustomers_REF data flow to prepare the data set used for simulations. This data is based on a Monte Carlo dataset, which is generated.

- Click Actions > Run to initialize the customer data.

- Click Submit to submit the customer data.

- Click Start to populate the customer data.

Note: Notice that the prospect data is populated once the test run is complete.

- Close the data flow Test run window.

2 Add business weight to actions

- In Next Best Action Designer, click the Engagement policy tab.

- Click CreditCards.

- In the Offers section, click Standard card to open the card offer details.

- In the upper right, click Check out to check out the group-level conditions.

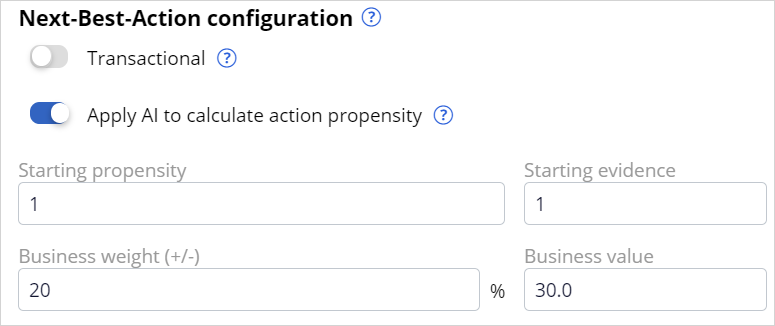

- In the Next-Best-Action configuration section, in the Business weight field, enter 20.

- Click Check-in to save the changes.

- Close the action to return to the Engagement policy tab.

- In the Offers section, click Rewards card to open the card offer details.

- In the upper right, click Check out to check out the group-level conditions.

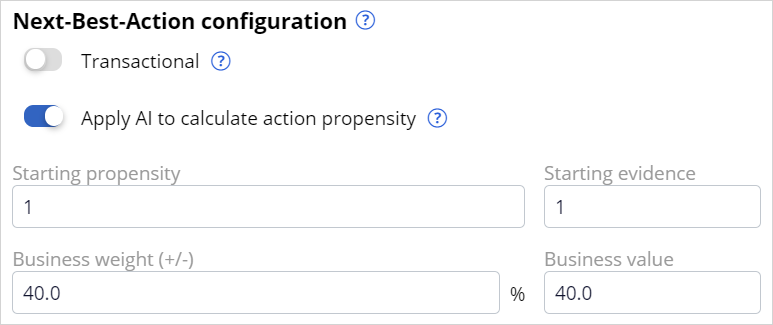

- In the Next-Best-Action configuration section, in the Business weight field, enter 40.

- Click Check-in to save the changes.

- Close the action to return to the Engagement policy tab.

3 Create and execute an arbitration audience simulation

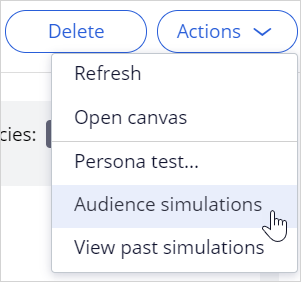

- Click Actions > Audience Simulations.

- Click Create simulation to create a new audience simulation.

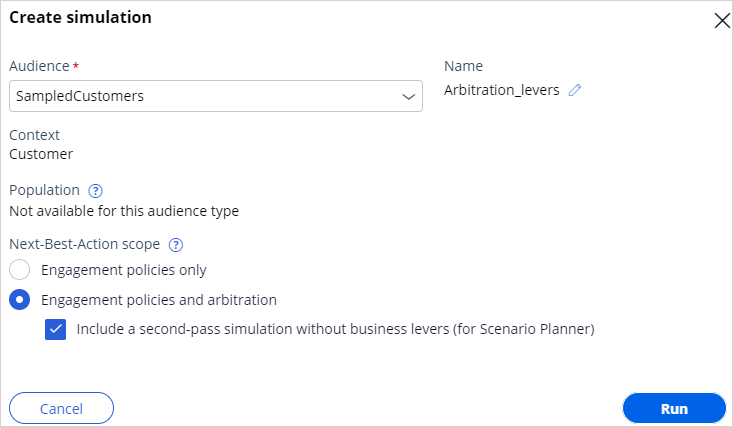

- In the Create simulation dialog box, configure the following information.

- Audience: SampledCustomers

- Next-Best-Action scope: Engagement policies and arbitration

Note: The Include a second-pass simulation without business levers (for Scenario Planner) check box enables you to compare the simulation results to analyze the effectiveness of assigning an increased business weight to specific actions.

- Name: Arbitration_levers

- Click Run to execute the simulation.

- Inspect how the customers are filtered at the Next Best Action Designer level for every engagement policy condition.

4 Analyze the simulation results in Scenario Planner

| Question: What is the effect of applying the business levers? Is there an indication of an opportunity cost or opportunity gain? |

- In the navigation pane of Pega Customer Decision Hub, click Discovery > Scenario Planner.

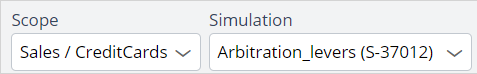

- In the Scenario Planner window, enter or select the following information:

- Scope: Sales/Credit cards

- Simulation: Arbitration_levers (S-#####)

- Click Apply.

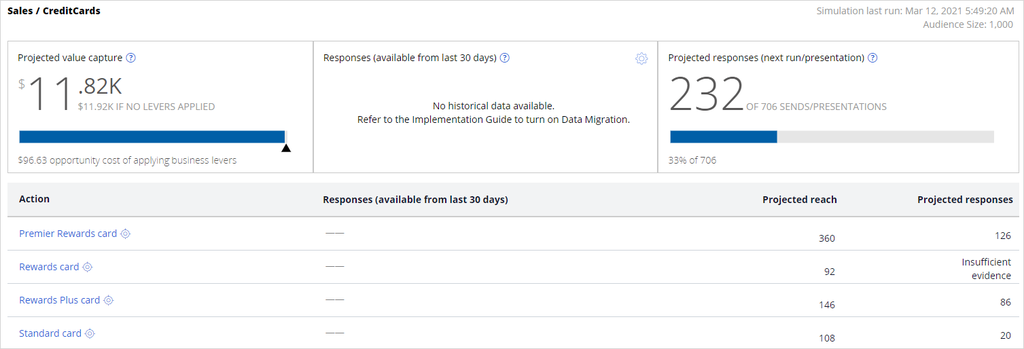

-

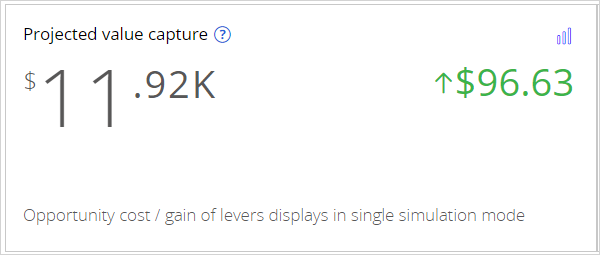

Inspect the results.Note: The Monte Carlo data set generates a mock data set. As a result, different simulation runs have different results.Note: In this example, the Scenario Planner projected value capture for the simulation with levers is $ 11.82K, and the projected value capture of the simulation without levers is $11.92K. In this example, there is an opportunity cost involved as there is a difference of $96.63K.

| Question: How does the application of business levers affect the percentage of accepts? |

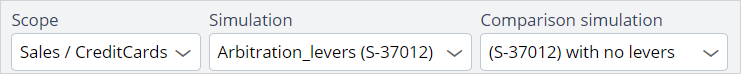

- In the Scenario Planner window, as the Comparison simulation list, select (S-#####) With no levers.

- Click Apply.

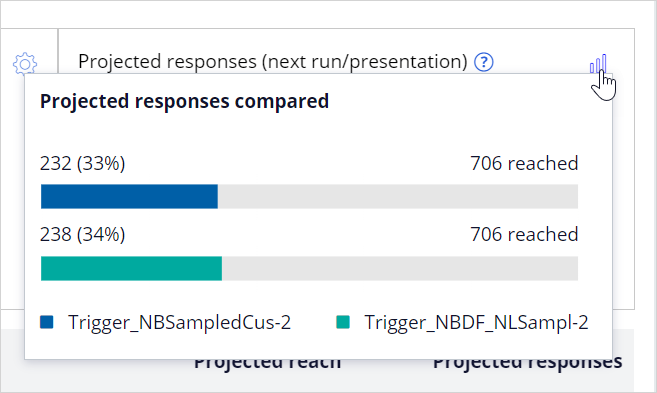

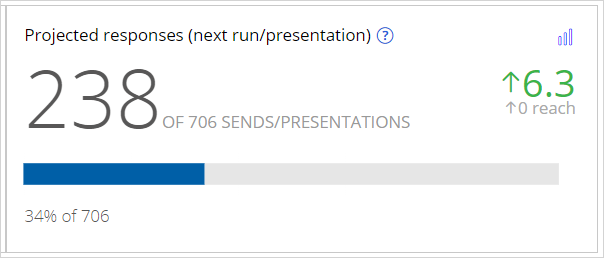

- In the Projected responses (next run/presentation) tile, click the Graph icon to view the difference in the percentage of accepts.

Note: In this example, the projected response is 33% for the simulation with levers and 34% for the simulation without levers. That is, the projected responses are more when the business does not apply business levers.

| Question: Which actions are traded off if the business levers are applied and what is the volume? |

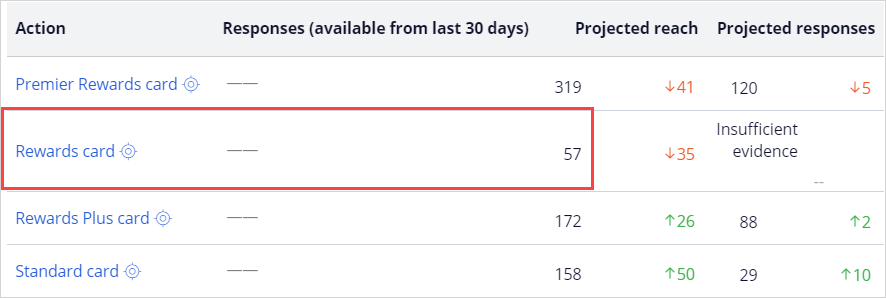

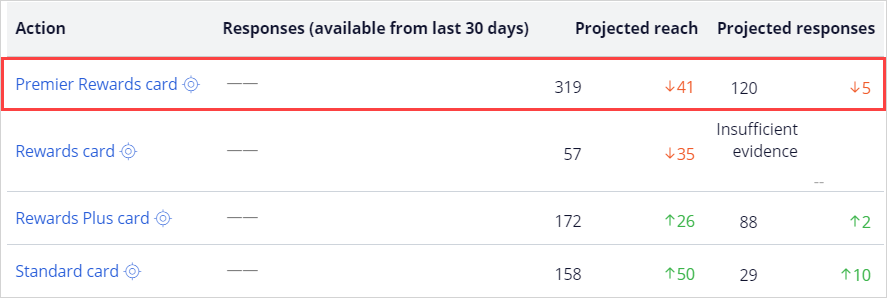

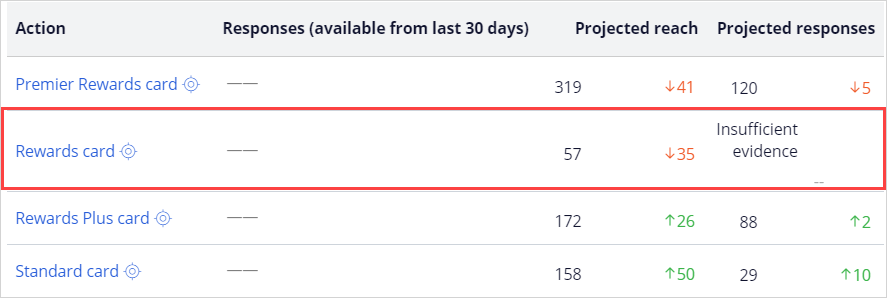

- Scroll down to view the Projected reach per action.

Note: In this example, you can see the 41 additional Premier rewards card and 35 additional Rewards card offers are presented in green. The 26 fewer Rewards plus and 50 fewer Standard cards are in red.

Question: How many times is the Rewards card is sent or presented to customers before and after applying business levers? Note: The Rewards card is sent or presented 92 times when the business levers are applied. - Click the (S-#####) With no levers tab to view the results of the simulation without business levers.

- Scroll down to view the Projected reach per action.

Note: Rewards card is sent or presented 57 times when the business levers are not applied, 35 times fewer than the scenario with business levers.

Question: How many customers are likely to accept the Premier Rewards card when the business levers are not applied? Note: Projected response is the number of expected accepts per card. 120 customers are likely to accept the Premier Rewards card when the business levers are not applied. That is, 5 fewer acceptances than the scenario with business levers.Note: When the adaptive model of an action does not have enough data projection to predict, the system indicates that there is insufficient evidence.

| Question: Which scenario is more profitable for the business? |

- Inspect the Projected value capture tile and note the opportunity gain indicated in green.

- Inspect the Projected responses tile and note the increase in projected responses indicated in green.

Note: In this example, the scenario without levers is more profitable as the projected value capture is higher by $96.63.

Available in the following mission:

If you are having problems with your training, please review the Pega Academy Support FAQs.

Want to help us improve this content?