Creating customer risk segments using a decision table

Archived

7 Tasks

25 mins

Scenario

U+ Bank is cross-selling on the web by showing various credit cards to its customers. The bank already uses a customer’s credit score to determine their suitability for a credit card.

The bank wants to implement eligibility rules that prevent high-risk customers from receiving credit cards offers. These new eligibility rules require customers to be divided into risk segments that range from AAA to CCC. The risk segments are determined based on the customer’s outstanding loan amount and credit score.

Only customers that belong to certain risk segments are eligible for a credit card.

Use the following credentials to log in to the exercise system:

|

Role |

Username |

Password |

|

Decisioning Analyst |

CDHAnalyst |

rules |

|

Decisioning Administrator |

CRMDecisioningAdministrator |

install |

Caution: This challenge is built on the challenge "Building a scorecard to calculate the credit score". Hence when you click on Initialize Pega or Reset Instance in this challenge, you first need to complete the previous challenge.

The risk segments are determined by two parameters:

- Outstanding loan amount – Value available in the Principal Loan property of the customer data model

- Credit score – Score determined by the Determine Credit Score scorecard

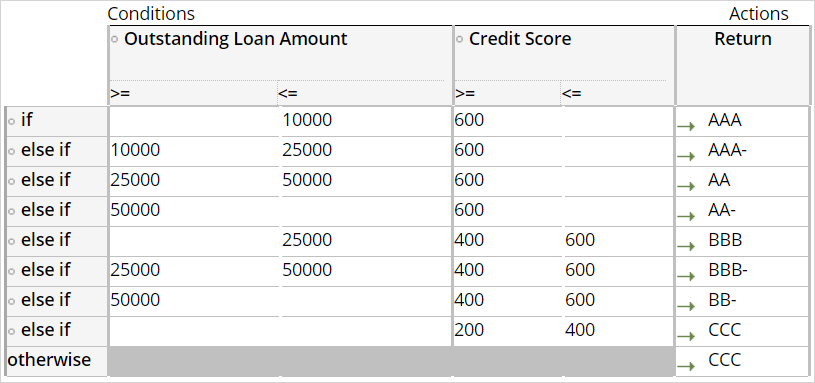

The following table describes the risk segmentation:

|

Condition |

Risk Segment |

|

If Outstanding loan amount < $10000 AND Credit score is > 600 |

AAA |

|

If Outstanding loan amount between $10000 and $25000 AND Credit score is > 600 |

AAA- |

|

If Outstanding loan amount between $25000 and $50000 AND Credit score is > 600 |

AA |

|

If Outstanding loan amount > $50000 AND Credit score is > 600 |

AA- |

|

If Outstanding loan amount < $25000 AND Credit score is between 400 and 600 |

BBB |

|

If Outstanding loan amount between $25000 and $50000 AND Credit score is between 400 and 600 |

BBB- |

|

If Outstanding loan amount > $50000 AND Credit score is between 400 and 600 |

BB- |

|

If Credit score is between 200 and 400 |

CCC |

|

If Outstanding loan amount AND Credit score falls in any other range |

CCC |

Your assignment consists of the following tasks:

Task 1: Create a decision strategy to determine customer credit scores.

Create a decision strategy and import the DetermineCreditScore scorecard rule to determine customer credit scores.

Task 2: Create a Decision Table

Create a decision table that implements the bank’s risk segmentation requirement as per the table above.

Task 3: Ensure customers in the risk category BB- and CCC are not eligible for credit cards.

Amend the decision strategy to ensure customers in a given risk category are not eligible for offers. Ensure that customers in the risk category of BB- and CCC are ineligible for credit cards. Customers from all other risk segments are eligible.

Task 4: Test the strategy for different customers

Verify that customer Robert is ineligible for a credit card, while Arnold is eligible. Use the information in the following table for verification.

|

Customer |

Outstanding Loan |

Credit Score |

Eligible |

|

Robert |

180000 |

300 |

NO |

|

Arnold |

8000 |

400 |

YES |

Task 5: Ensure the Risk Segmentation decision strategy can be used as the Eligibility strategy in the Next-Best-Action Designer.

Add the decision strategy as a relevant record in Dev Studio so that it can be used as eligibility strategy in the Next-Best-Action Designer.

Note: To access Dev Studio, log in as Decisioning Administrator.

Task 6: Amend Next-Best-Action Designer’s Eligibility criteria for the Credit Cards Group.

Amend Next-Best-Action Designer’s eligibility criteria for the Credit Cards group as such: credit cards are eligible for all the other risk segments except for customers belonging to risk segment BB- and CCC.

Task 7: Confirm your work.

Challenge Walkthrough

Detailed Tasks

1 Create a decision strategy to determine customer credit scores.

- Log in as Decisioning Analyst with user name CDHAnalyst and password rules.

- In the navigation pane on the left, click Intelligence > Strategies.

- In the upper right, click Create > Start with new canvas.

- On the Create Strategy page, enter or select the following information:

- Short description: Risk Segmentation

- Business issue/Group: Sales/CreditCards

- Development branch: No branch

- Apply to: PegaCRM-Data-Customer

- Click Create and open.

- On the canvas, right-click , and then select Enable external input to enable external inputs.

- On the canvas, right-click and then select Decision analytics category> Scorecard to add a scorecard model component.

- Click scorecard model component, and then select Properties.

- In Scorecard model properties window, in the Scorecard model field, enter or select DetermineCreditScore.

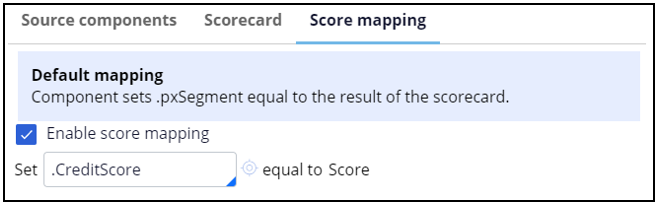

- Click the Score mapping tab to enable the score calculation.

- Select the Enable score mapping check box.

- In the Set field, enter or select CreditScore.

-

- Click Submit

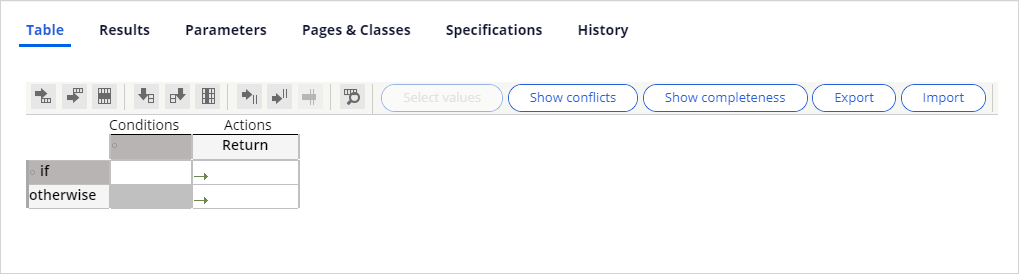

2 Create a Decision Table

Task 2: Create a decision table

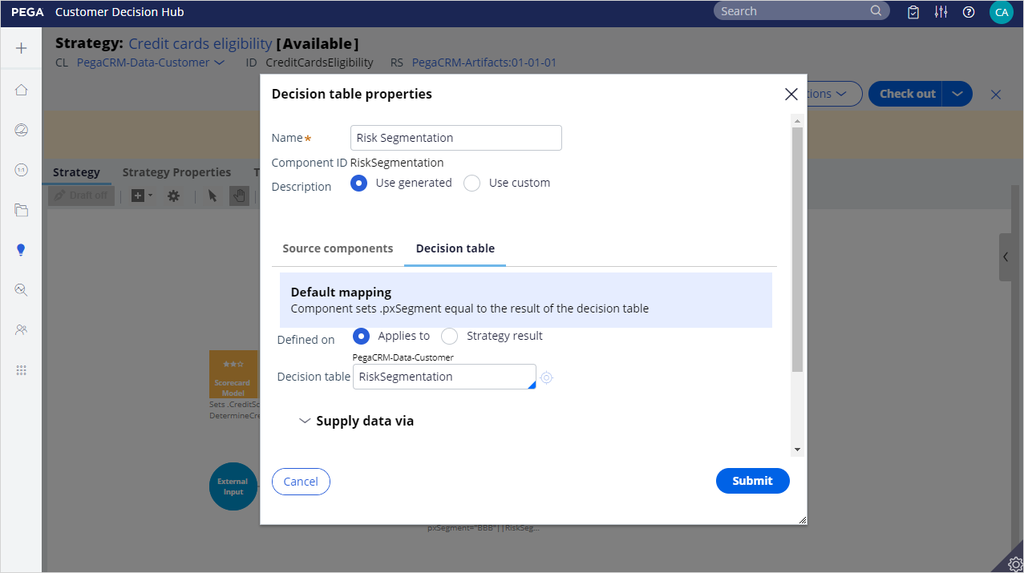

- On the canvas, right-click, and then select Business rules > Decision table to add a Decision table component.

- Open the Decision table component properties.

- In the Name field, enter Risk Segmentation.

- Set the Decision table value to RiskSegmentation.

- To the right, click the Open icon to create the decision table.

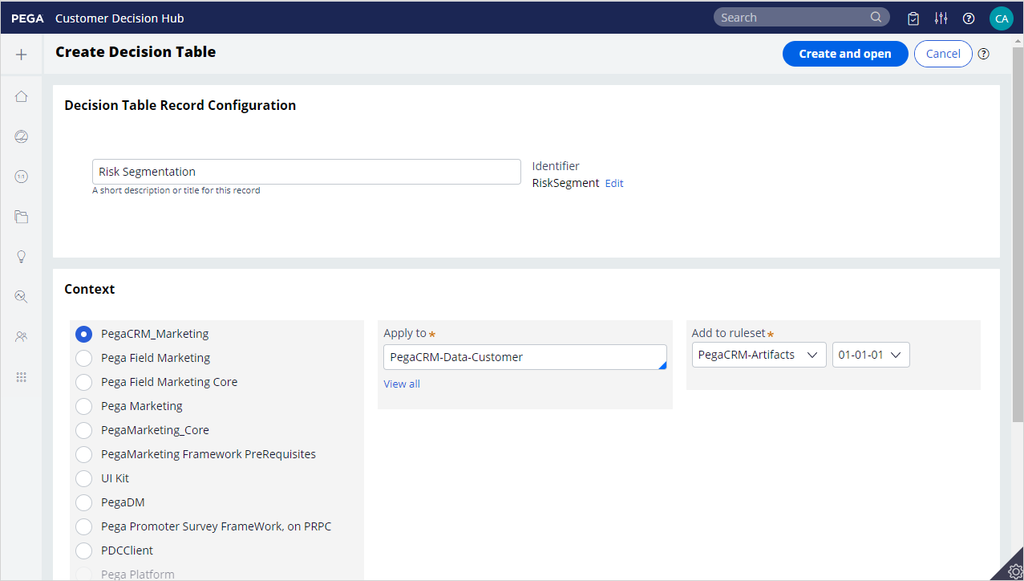

- On the Create Decision Table page, ensure that Development branch [No branch] is selected.

- Change the Apply to class to PegaCRM-Data-Customer.

- Click Create and open.

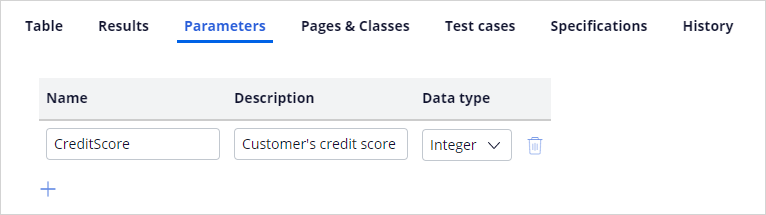

- Click the Parameters tab and enter the following details.

- Name: CreditScore

- Description: Customer’s credit score

- Date type: Integer

- In the Table tab, in the tool bar, click Insert column After to add another column..

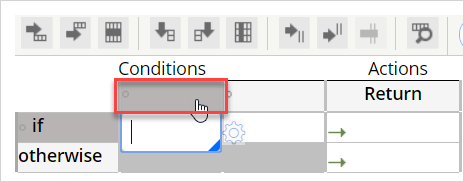

- In the Conditions column, click the first cell to select the first Property.

- In the Property field, enter or select .PrincipalLoan.

- In the Label field, enter Outstanding loan amount.

- Select the Use Range check box.

- Click Save to return to the Table tab.

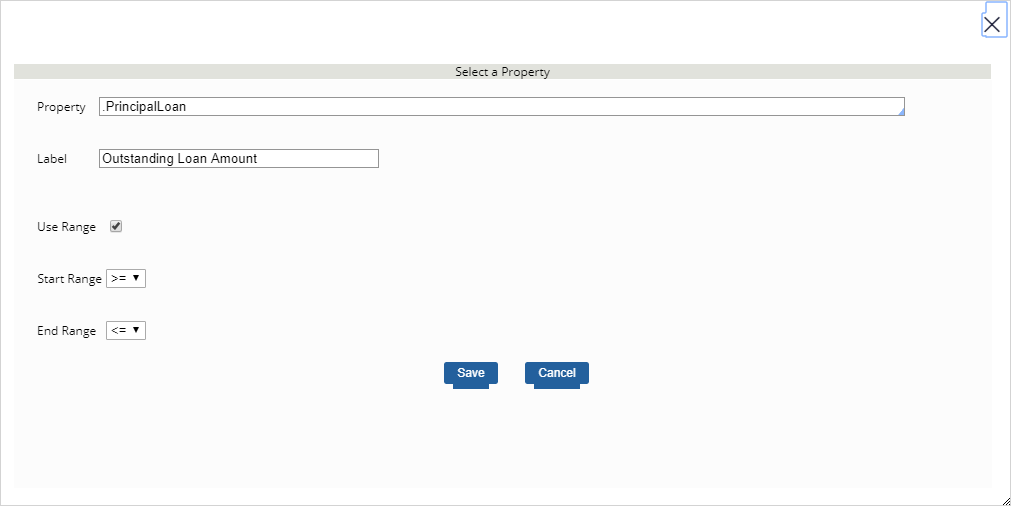

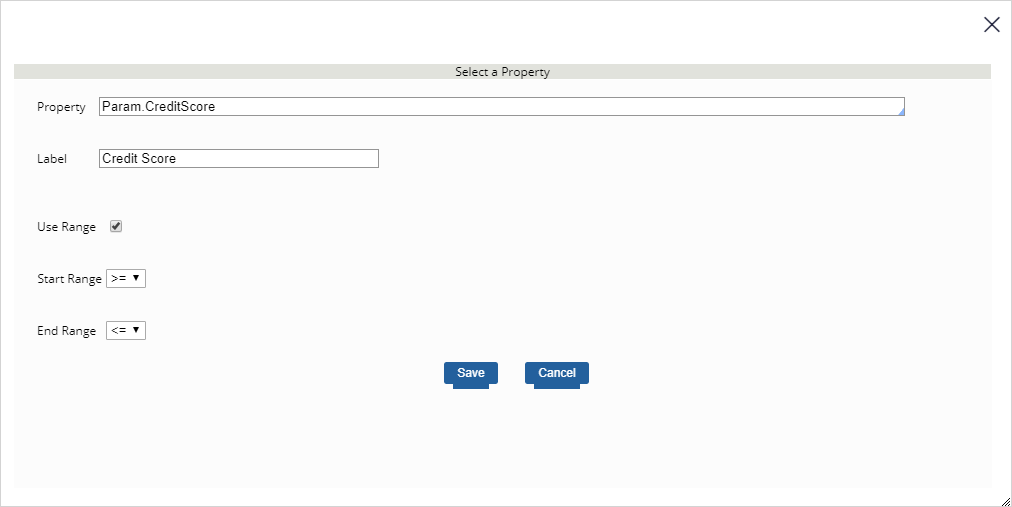

- In the Conditions column, click the second cell, and then enter the following information:

- In the Property field, enter Param.CreditScore.

- In the Label field, enter Credit Score.

- Select the Use Range.

- Click Save to return to the Table tab.

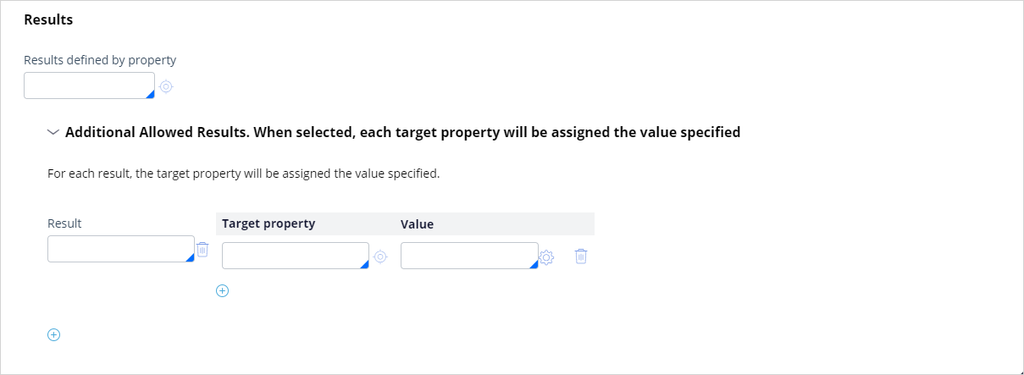

- Click the Results tab.

- In the Results tab, expand Additional Allowed Results.

- In the Result field Enter AAA.

- Click the Add icon to add the next result.

- Repeat step 16 to add the results AAA-, AA, AA-, BBB, BBB-, BB-, and CCC.

- Click Save.

- Go to the Table tab and Check Out.

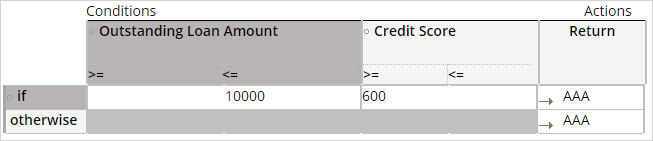

- In the if row, enter the following values:

- Outstanding Loan Amount: 10000

- Credit Score: 600

- Return: AAA

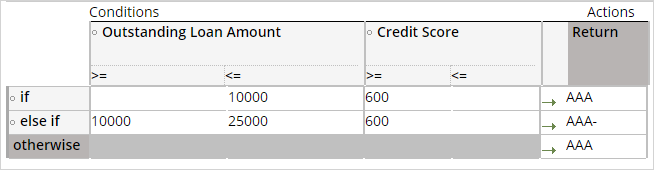

- Click the Insert Row After icon to add an else if row. Enter the following values in that row:

- Outstanding Loan Amount range: 10000 - 25000

- Credit Score: 600

- Return: AAA-

- Enter the following eligibility conditions and return values.

- Click Check in to save and close the decision table.

3 Ensure that customers in the risk category BB- and CCC are ineligible for credit cards

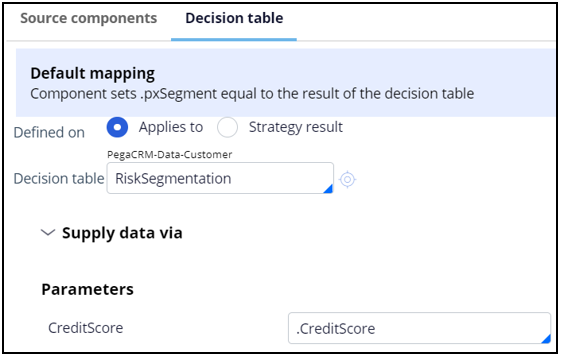

- In the Decision Table properties window, in the Decision table field, enter or select RiskSegmentation.

- Expand the Supply data via section and set the CreditScore parameter to .CreditScore.

- Click Submit.

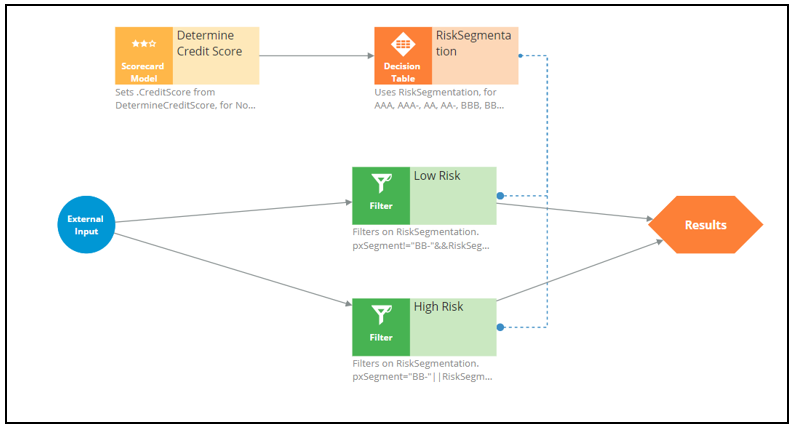

- On the canvas, connect the Determine Credit Score component to the Risk Segmentation component.

- On the canvas, right-click, and then select Arbitration > Filter to add a filter component.

- Right-click the Filter component, and then select Properties.

- In the Name field, enter Low Risk.

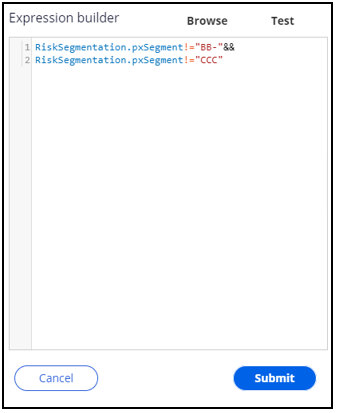

- Open the Expression builder to define the condition as RiskSegmentation.pxSegment!="BB-"&& RiskSegmentation.pxSegment!="CCC".

- Click Submit.

- Add another Filter component.

- Right-click the Filter component to enter the properties.

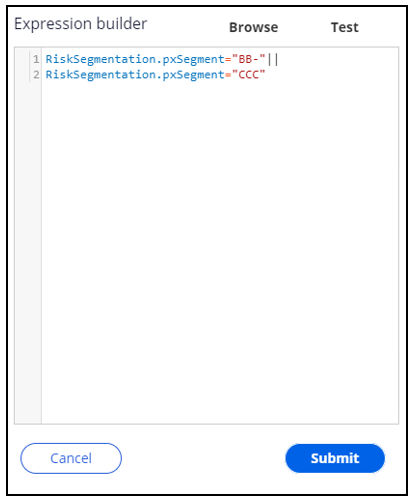

- In the Name field, enter High Risk.

- Open the Expression builder to define the condition as RiskSegmentation.pxSegment="BB-"|| RiskSegmentation.pxSegment="CCC.

- Click Submit.

- A dotted line connects the Risk Segmentation decision table component to the Filter component.

- Connect the External Input to both Filter components and then the Filter components to the Results. The strategy should look like the following image.

-

- Save the strategy.

4 Test the strategy for different customers

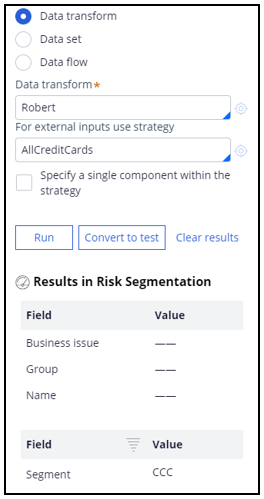

- Log in to the U+ Bank website as Robert to test the strategy with AllCreditCards in the For external inputs use strategy field.

- Click Run.

- On the canvas, click the Risk Segmentation component, and then verify that the decision table classifies Robert in the CCC risk category.

- Click the Low Risk Filter component and confirm that Robert is ineligible for any of the credit cards.

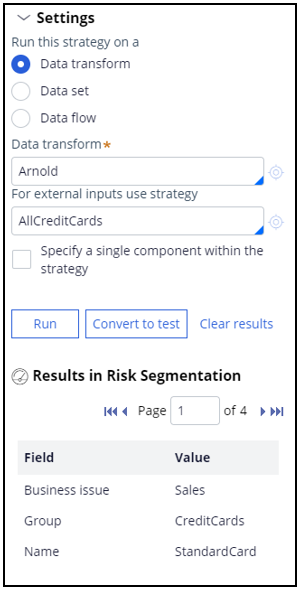

- Repeat step 4 to verify that Arnold is categorized in the BBB risk segment and is eligible for all credit cards.

5 Add a relevant record for the decision strategy created.

- Log in as Decisioning Administrator with user name CRMDecisioningAdministrator and password install.

- In the header of Dev Studio, click Configure to add a relevant record.

- Click Application -> Inventory -> Relevant Records.

- In the Class name list, select PegaCRM-Data-Customer.

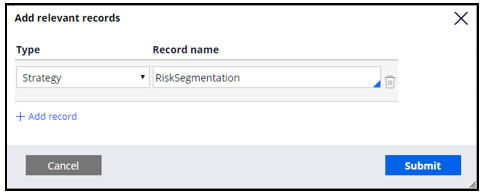

- Click Add records.

- In the Type list, select Strategy.

- In the Record name field, enter or select Risk Segmentation

- Click Submit.

- In the lower left, click the user profile image, and then select Log off.

6 Amend Next-Best-Action Designer’s Eligibility criteria for the Credit Cards Group.

- Log in as Decisioning Analyst with user name CDHAnalyst and password rules.

- In Customer Decision Hub, click Next-Best-Action > Designer.

- In the Next-Best-Action Designer click Engagement policy to access the engagement policies.

- In the Business structure, click the CreditCards group.

- Click Edit.

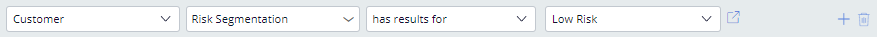

- In the Eligibility section, click the Add icon to add a new row.

- In the first drop-down, click the down arrow.

- In the list, select Strategy > Risk Segmentation.

- Ensure that has results for Low Risk is selected.

- Click Save.

7 Confirm your work

- From the Exercise System landing page, click on U+ Bank to open the website.

- On the website main page, on the top right, click Log in to log in as a customer.

- Log in as Robert, and verify that he is not eligible for any card offers.

- Log in as Arnold, and verify that he is eligible for card offers.