Exploring cross-sell on the web

2 Tasks

20 mins

Scenario

U+ Bank recently completed a project where customers who log in to their account page on the website see credit card offers.

Upon login to the U+ Bank website, customers see the offers that they qualify for based on the engagement polices defined by business.

The business team has classified the engagement policies into three groups:

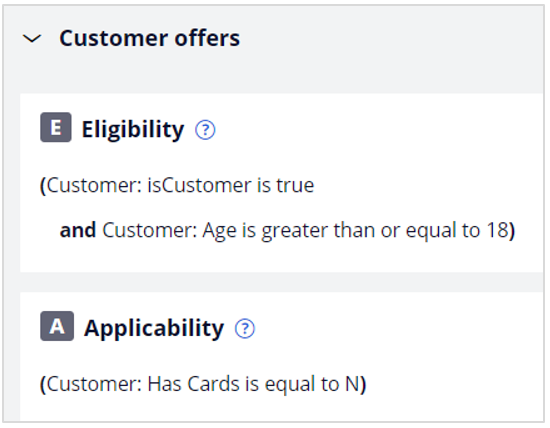

- Eligibility rules, which are the “hard” rules representing what is even possible to offer.

- Applicability rules, which represent business practices that limit what to offer based on a customer’s current situation but are not as "hard" as Eligibility.

- Suitability rules, which are rules that are the least "hard" but represent what the business should and should not do ethically and empathetically.

Some of the criteria apply to the entire credit card group and some apply to specific actions. The following table contains the list of the detailed requirements implemented:

|

Action |

Type |

Condition: Customer... |

|---|---|---|

|

All credit cards |

Eligibility |

is a valid U+ Bank customer |

|

All credit cards |

Eligibility |

is at least 18 years or older |

|

All credit cards |

Applicability |

does not have a credit card |

|

Standard & Rewards |

Eligibility |

has recently onboarded |

|

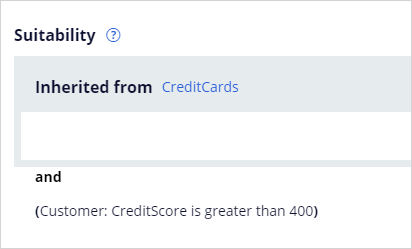

Rewards Plus & Premier Rewards |

Suitability |

has a credit score higher than 400 |

Use the following credentials to log in to the exercise system:

|

Role |

User name |

Password |

|---|---|---|

|

Decisioning Analyst |

CDHAnalyst |

rules |

Your assignment consists of the following tasks:

Task 1: Verify offers on the U+ website

Explore the behavior of the website and verify that customers Troy, Barbara, and Robert receive the correct offers based on their profile. Use the information in following tables for verification.

|

Customer |

isCustomer |

Age |

Has Cards |

LifeCyclePeriod |

CreditScore |

|---|---|---|---|---|---|

|

Troy |

true |

26 |

N |

Onboard |

200 |

|

Barbara |

true |

32 |

N |

Retain |

450 |

|

Robert |

true |

26 |

N |

Onboard |

600 |

Task 2: Review the Next-Best-Action Designer configurations

Review the artifacts created in the Pega Customer Decision Hub portal and the configurations created in the Next Best Action Designer:

- Next Best Action Designer Engagement policy tab, where all engagement policy rules are defined.

- The set of Actions and Treatments created for the Credit cards group, including the specialized engagement rules like applicability and suitability.

- Next Best Action Designer Arbitration tab and Channels tab.

Challenge Walkthrough

Detailed Tasks

1 Verify offers on the U+ website

- From the exercise system landing page, click on U+ Bank to open the website.

- On the website main page, on the top right, click Log in to log in as a customer.

- In the Username field, ensure Troy is selected.

- Click Sign in to log in as Troy.

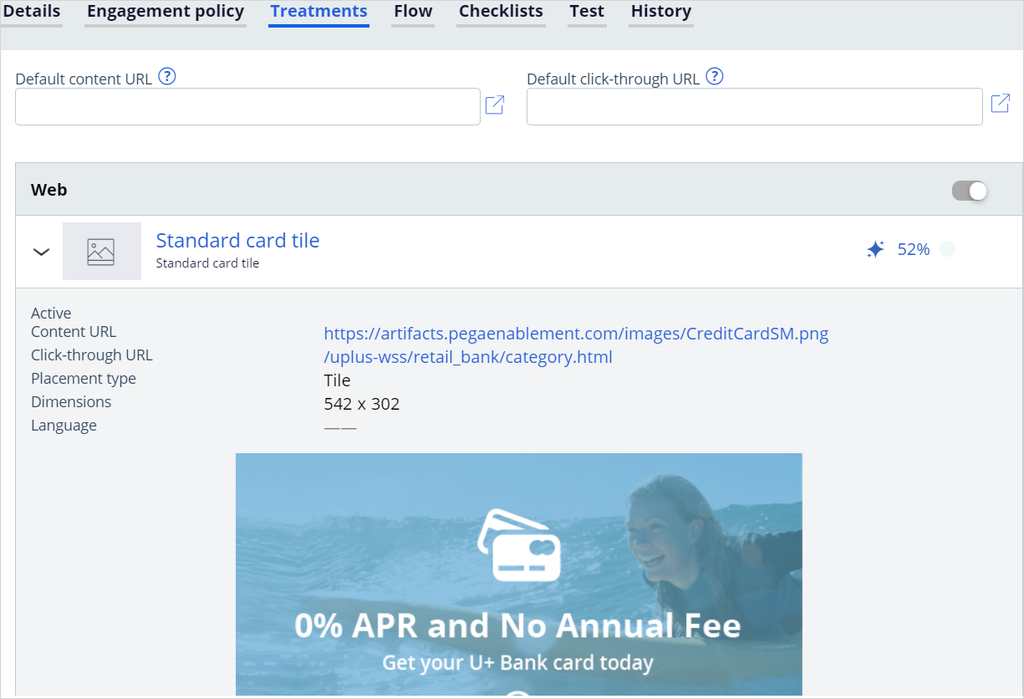

The Standard card offer banner is displayed. This is the web treatment of type “tile” that is associated with the Standard card action.Note: Initially, a default banner is displayed for a few seconds. You experience this delay only for the first time. The offer loads quickly when you log-in next time.

- In the upper right, click the profile image and select Log out.

- Repeat steps 1-5 to log in as Barbara and as Robert, and verify that each of the customers sees an offer that is correct as per the engagement policy defined. Use the information in the following table for verification.

Customer

isCustomer

Age

Has Cards

LifeCyclePeriod

CreditScore

Troy

true

26

N

Onboard

200

Barbara

true

32

N

Retain

450

Robert

true

26

N

Onboard

600

Note: Due to the engagement rules defined in the system, the following offers are valid for each of the customers. Therefore, when you log in as a customer, one of these offers is presented.Customer

Standard

Rewards

Rewards Plus

Premier Rewards

Troy

Y

Y

Barbara

Y

Y

Robert

Y

Y

Y

Y

- Can you explain why the customers receive these offers?

Note: Each of the three customers is above 18, does not own a credit card, and is currently a U+ bank customer, so the customers satisfy the generic credit card eligibility and applicability criteria.

Troy does not see Rewards Plus & Premier Rewards because these offers are not suitable as his credit score is below 400.

Barbara did not recently onboard, therefore Standard & Rewards are not eligible for her.

Robert did recently onboard and his credit score, 600, is higher than the 400 threshold; therefore, Robert qualifies for all four offers.

2 Review the Next-Best-Action Designer configurations

- Log in to Customer Decision Hub as the Decisioning Analyst with User name CDHAnalyst using Password rules.

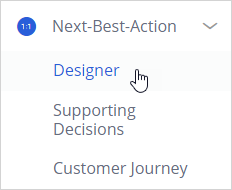

- In the navigation pane on the left, click Next-Best-Action > Designer.

- In the Next-Best-Action Designer, click Engagement policy.

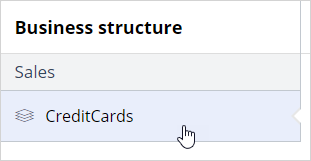

- In the Business structure, click the CreditCards group to view the engagement policy for the group.

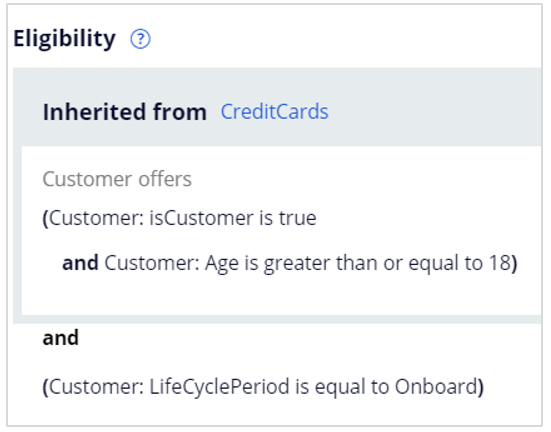

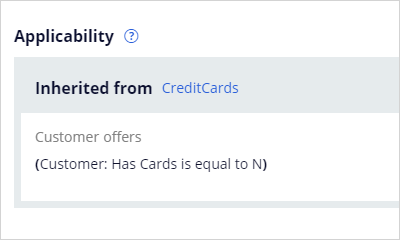

- Examine the group level eligibility and applicability rules.

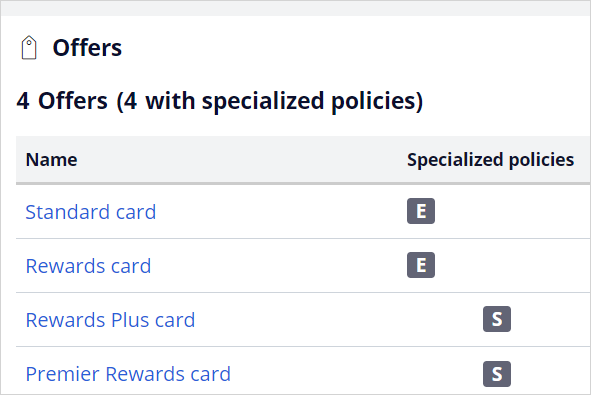

- Scroll down and confirm that the four offers are configured with specialized policies:

- Click Standard card to open the policy.

- Click the Engagement Policy tab and notice that both the group level eligibility rules (is a valid U+ Bank customer and is at least 18 years or older) and the specialized Action level eligibility rule (has recently onboarded) are defined.

- Under Applicability, verify that the group level applicability rule (does not have a credit card) is defined.

- Click the Treatments tab.

- Expand the Web treatment and verify that one treatment is created for this action:

- Close the Standard card action and similarly,

- Repeat steps 7-12 for the other cards. Notice that the correct applicability and suitability is defined. For example, Rewards Plus and Premier Rewards actions are suitable if the customer’s credit score is higher than 400.

- Optional: Verify that each action has one treatment defined.

- Click the Arbitration tab and verify that the final priority is determined using Propensity and Business levers:

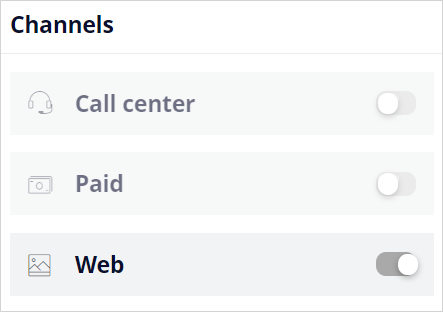

- In the Channel tab, verify that the Web switch is turned on:

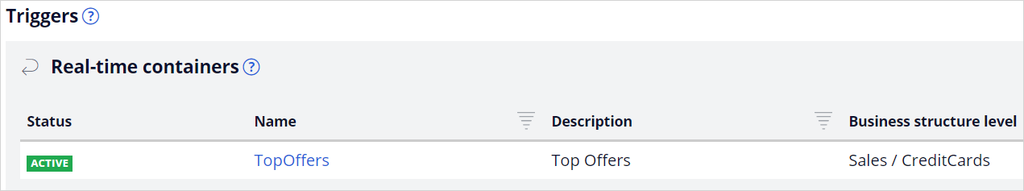

- In the Channels tab, verify that one real-time container is configured and points to the CreditCards group:

Available in the following mission:

If you are having problems with your training, please review the Pega Academy Support FAQs.

Want to help us improve this content?