Prioritizing actions using AI

Archived

4 Tasks

20 mins

Scenario

When customers log in to the U+ Bank website, they see the credit card offers for which they qualify based on the engagement policy defined by the business.

When customers qualify for multiple credit card offers, artificial intelligence (AI) decides which best offer to show.

The business understands how the Pega Customer Decision Hub™ AI works in the context of the web channel. When a customer sees an offer but does not click it, the AI considers this as a negative behavior and lowers the propensity of the offer. When the customer clicks on the offer, the propensity is increased.

To complete the assignment, use the following credentials:

|

Role |

User name |

Password |

|---|---|---|

|

Decisioning Analyst |

CDHAnalyst |

rules |

Your assignment consists of the following tasks:

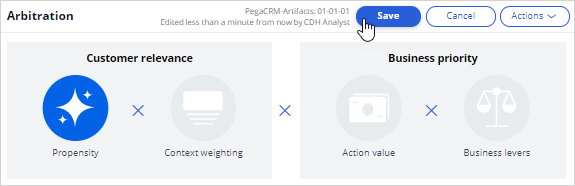

Task 1: Enable propensity in arbitration.

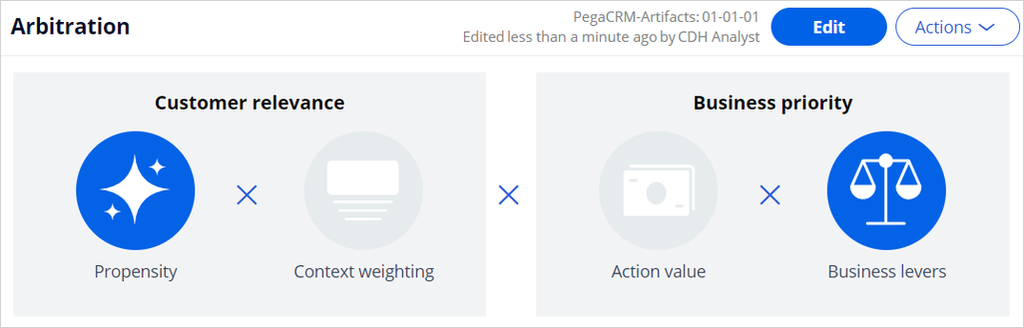

In the Arbitration section of Next-Best-Action Designer, keep only the Propensity enabled to ensure that only AI is used in arbitration process to select the top action.

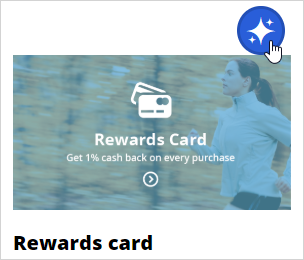

Task 2: Verify the negative behavior.

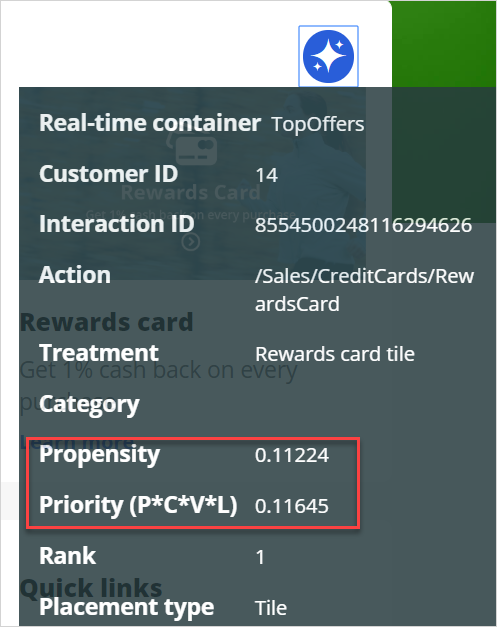

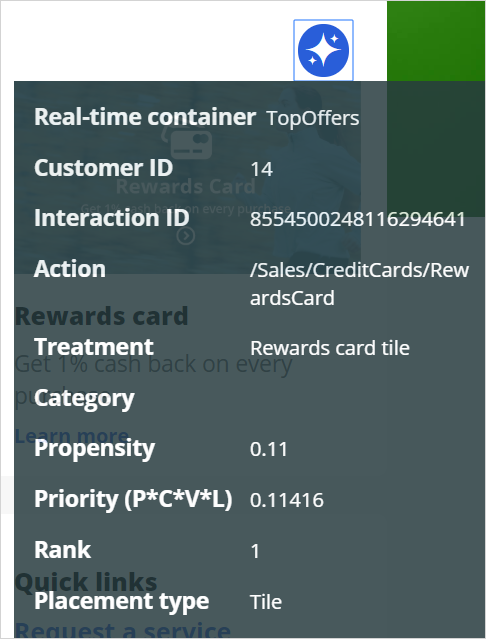

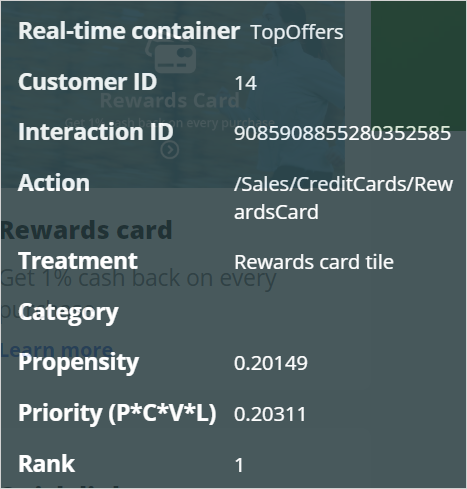

Successively log in to the U+ Bank website as Troy, but do not click the offer. Notice that after multiple logins, the propensity of an offer decreases when you do not click. Use the Polaris icon next to offer to examine the propensity value.

Note: The Priority value is used to prioritize actions and select the top action. Because you enabled only Propensity, the Priority is equal to Propensity. The negligible difference is due to the smoothed propensity calculation, which is not in scope for this exercise.

Tip: You can also see the propensity of actions previously made to a customer in the Interaction History report. Troy’s subject ID is 14.

Task 3: Verify the positive behavior.

Log back in multiple times, and click an offer each time to record a positive behavior and to prove that the AI learns, and the propensity of the offer is increased for customers with a similar profile.

Note: The system decides when the actual learning happens. As a result, you might see some slight variations in the propensity and not a continuous increase after each click. However, multiple clicks lead to an increased propensity after a while.

Task 4: Examine the AI model.

Finally, in Pega Customer Decision Hub, examine the AI model behind the action / treatment.

Challenge Walkthrough

Detailed Tasks

1 Enable propensity in arbitration

- Log in to Customer Decision Hub as Decisioning Analyst with User name CDHAnalyst using password rules.

- In the navigation pane on the left, click Next-Best-Action > Designer.

- In the Next-Best-Action Designer, click Arbitration.

- On the Arbitration landing page, click Edit to modify arbitration settings.

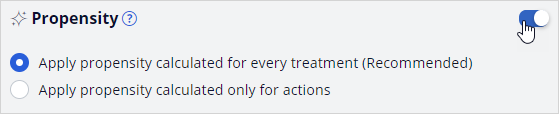

- In the Propensity section, ensure that the switch on the right is turned on.

- Scroll down to the Business levers section.

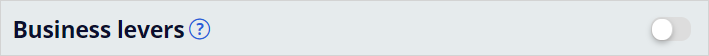

- To the right of Business levers, turn off the switch.

- At the top of the Arbitration landing page, click Save to save the changes to arbitration settings so that only the propensity, calculated by AI, is involved in action arbitration

2 Verify the negative behavior

- From the exercise system landing page, click U+ Bank to launch the U+ Bank website.

- In the U+ Bank website, in the upper-right corner, click Log in to log-in as a customer.

- In the Username list, ensure that Troy is selected, and then click Sign in. An offer is displayed.

Note: Do not click the offer. Each time you log out and then log in, Troy is presented with an offer but do not click on it.

- On the next offer, click the Polaris icon to view the Propensity and Priority values.

Note: The values you see in your system can be different depending on the number of times you log in to U+ Bank app.

- Perform successive logins without clicking the offer. Notice how the propensity decreases.

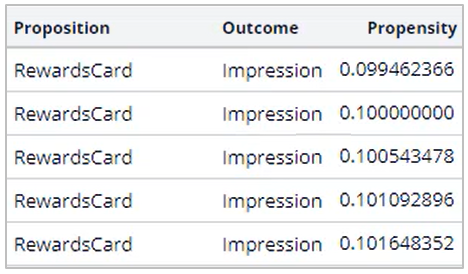

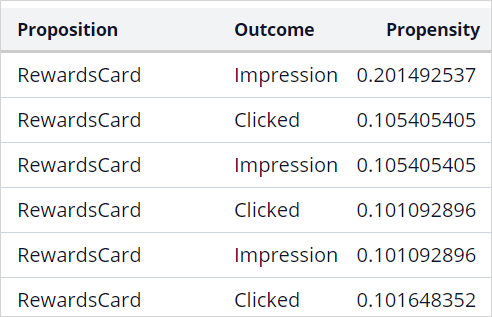

- You can also see the propensity of actions previously made to a customer in the Interaction History > Recent interactions report. The subject ID for Troy is 14.

- Notice how the impression is decreasing with every customer interaction.

Note: The values you see in your system vary depending on the number of times you log in to U+ Bank app.

3 Verify the positive behavior

- After you have tested the effects of negative behavior, click on Learn more link below the offer.

- Perform multiple log-ins and click Learn more each time. Doing so increases the propensity of the offer. After three log-ins and Learn more clicks, the propensity increases.

- In Interaction History:

Note: The system decides when the actual learning happens. Therefore, you might see some slight variations in the propensity, and not a continuous increase after every single click. However multiple clicks will lead to an increased propensity after a while.

4 Examine the AI model

- Log-in to Customer Decision Hub portal as the Decisioning Analyst.

- In the navigation pane on the left, click Intelligence > Prediction Studio to view the AI models in Prediction Studio.

- Click Models to view the AI models.

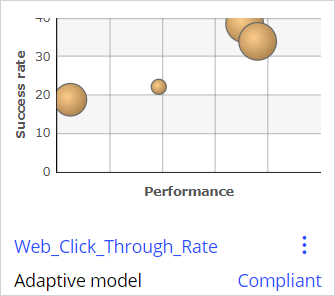

- Scroll down, locate the Web_Click_Through_Rate, and click to open the treatment level model.

Note: Analyzing the AI models in detail is beyond the current scope. For now, just examine the list of predictors and the outcomes already configured by a Data Scientist.

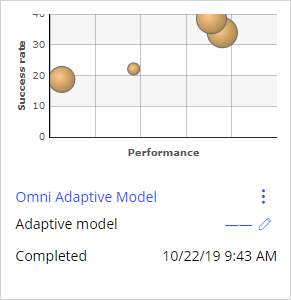

- The main monitoring screen shows an overview of all the models in a given channel:

The best performing model is the Rewards Plus card, with a performance of 88.01%. The model with the least responses, 484, is the Rewards Card.

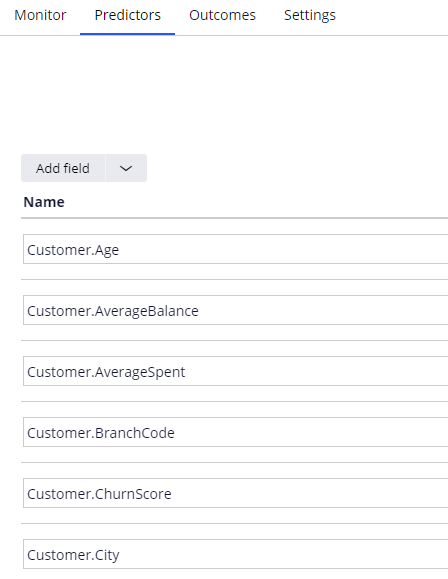

- The Predictors tab contains the list of predictors configured at the time of creating this model. The AI might not use all predictors.

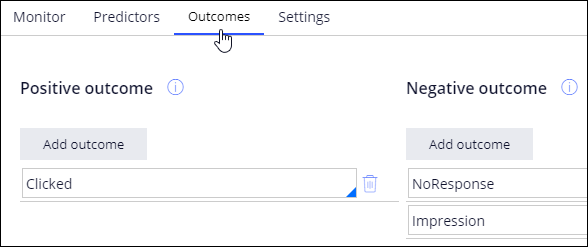

- The Outcomes tab contains the action outcomes mapped to positive and negative behaviors. Notice that Clicked is mapped to positive and Impression to negative.

- On the Monitor tab, open the Model Report for one of the models. For example, the Rewards Plus model:

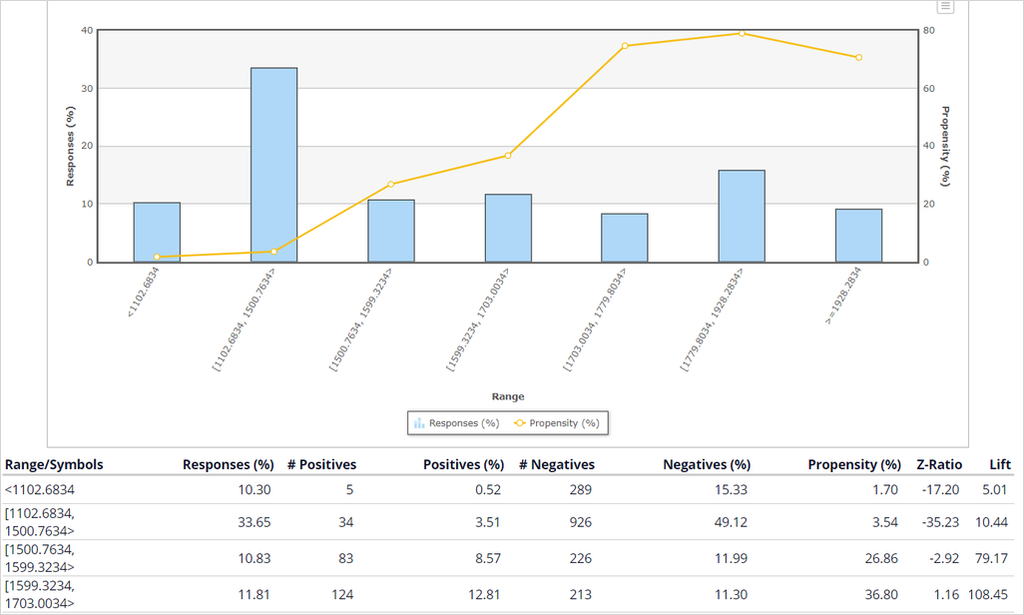

- In the Predictors tab, click a predictor to open it. Examine the unique values or number ranges in the predictor and value or range with the highest propensity.

- In the upper left, use the back button to navigate back.

- In Prediction Studio, open and refresh the Omni_Adaptive_Model as well. This is the action level model.

- In the lower-left corner, click Back to Customer Decision Hub to return to the Customer Decision Hub portal.

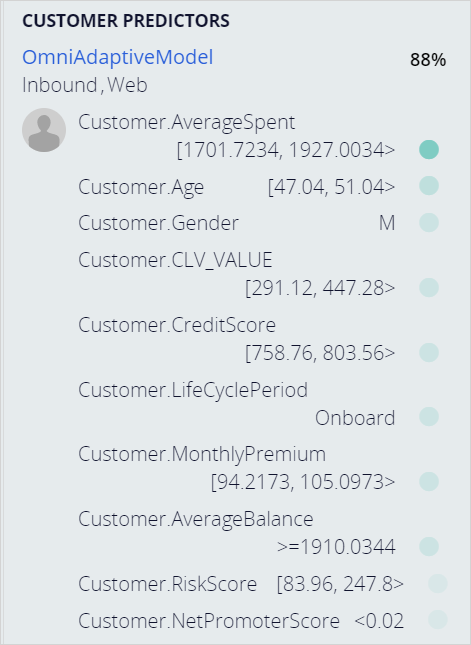

- Click Content > Actions to open any of the credit card actions. In the Details tab of the action, on the right, notice that a list of predictors used by the AI model is displayed. This AI model, OmniAdaptiveModel, is an action level model. This means that the model predicts the customer behavior not considering any particular treatment.

Example for the Rewards Plus card: - In the action, click on the Treatments to see the treatment level AI model

- Next to the web treatment, click the Polaris icon to view the details of the treatment-level AI model.

- The pop-up window gives you a snapshot of the treatment level AI model. You can see the current confidence level in predicting customer behavior and the predictors used to perform the predictions.