Collections service requests – payments

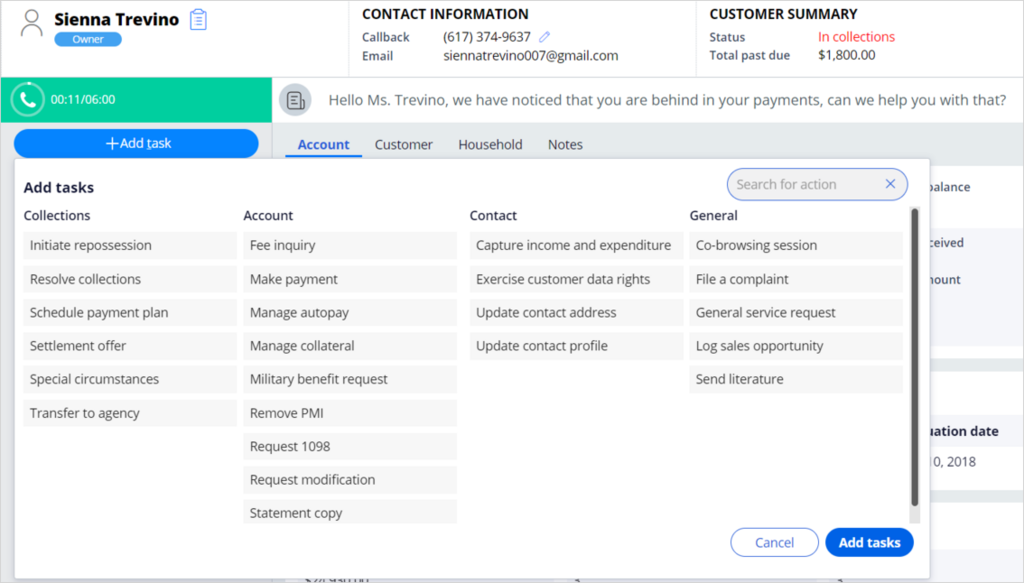

During an interaction with a customer, the Add Task button opens a pop-up window that lists, by category, all service requests for the customer and their accounts. When a customer account is in collections, collections actions appear in the list of available tasks. Similarly, if the customer has different product types, such as credit cards and loans, then the actions listed will be intelligently loaded based on the products.

In this topic you will explore the collections-specific service requests that are related to payments.

Schedule payment plan

The Schedule payment plan request type presents the user with a set of analytics-driven payment offers. The offers are designed to help the customer bring their account back within the terms of the contract.

The offers that the CSR can present to the customer are driven by the unified decisioning within Pega Collections. Unified decisioning uses all the available data to determine how to optimize the outcome of each payment offer for a given customer. The decisioning functionality within Pega Collections determines the most effective offers for each customer and presents them in a ranked order. Each offer is appropriate and valid, but the top offer is evaluated as the most effective, that is, it has the highest probability of success based on the business-defined criteria for a given customer. This solution drives good behavior by linking the best offers with the incentive scheme. Next to each of the offers, you can see a scoring system that shows the user the relative value of each offer. The highest payout is achieved by successfully negotiating the highest ranked offers.

The decisioning functionality can define and present as many offers as your business needs. The default display has the maximum number of offers set to 5. If you have inexperienced collectors or wish to push this functionality to a self-service website, then this number can be limited to one offer at a time.

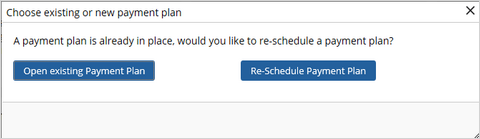

Only one arrangement is in effect at any time. If there is a payment plan already active for the given account, the user will be presented with the option to re-schedule their payment plan:

If the CSR is an experienced user, they also have the option to build a new offer (Custom). In the new offer, they can enter any valid values that they have agreed upon with the customer.

Once the offer is selected, the system displays the payment details. The CSR selects the payment method chosen by the customer. The promise is assessed based on the promise date, as well as any grace days given for differences in payment method clearing times. The user can choose to use the same information for all subsequent payments to make the creation of a payment plan as efficient as possible.

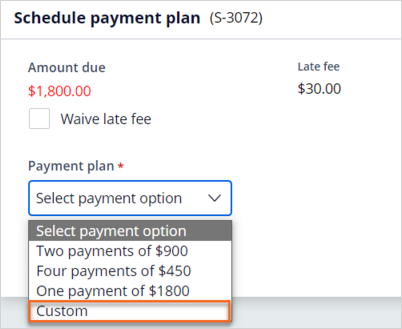

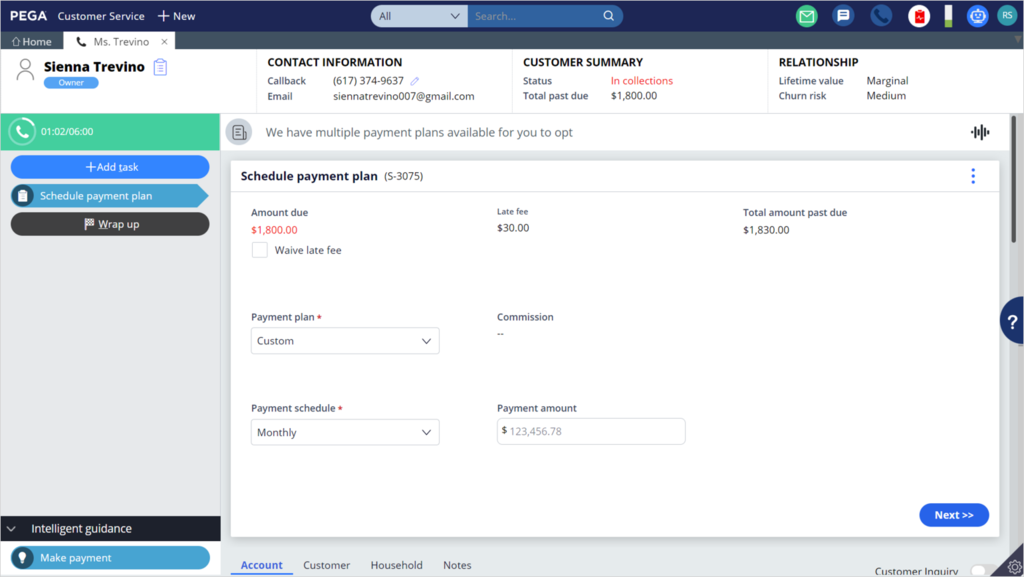

The following figure shows a custom payment plan selected in the Schedule payment plan composite:

After selecting Custom as the Payment plan, the CSR is presented with a set of options to define a unique plan. A calculator is used to determine the correct payments for a time-based or value-based plan. Parameters defining the maximum duration and minimum payment values are set by the business to ensure that plans adhere to payment arrangement policies. These values can be overridden by a supervisor if required.

Settlement offer

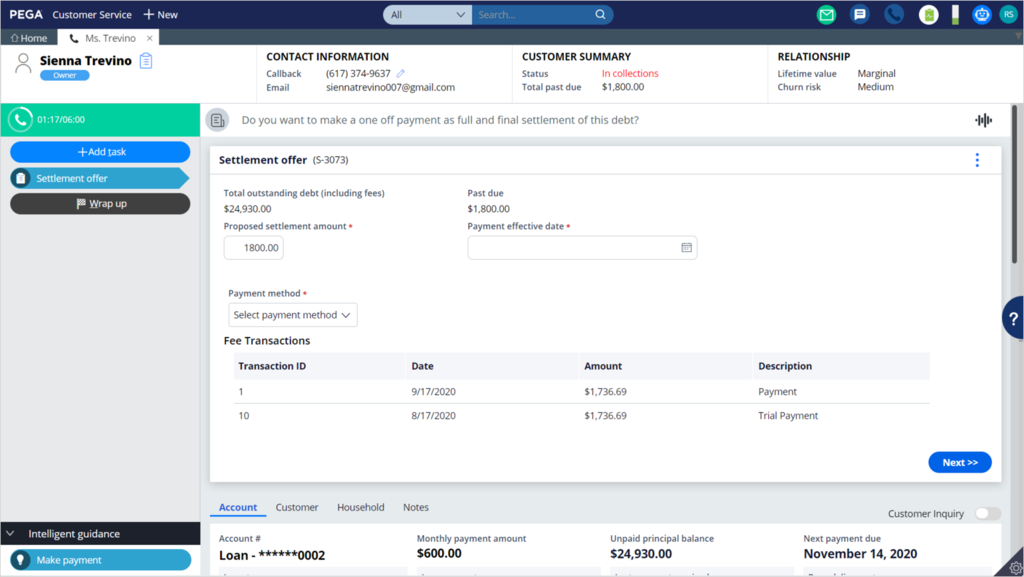

This service request type allows the CSR (based on permission levels) to create a settlement for the collections amount. Settlements can also be listed in the Schedule payment plan composite if decisioning and business rules determine that this is an effective and appropriate offer. The minimum values can be controlled using business-defined parameters.

The following figure shows the Settlement offer composite in the Interaction Portal, during an interaction with the customer:

With appropriate integration and a valid payment method available for the customer, the system automatically debits the account indicated on the date that the payment is requested.

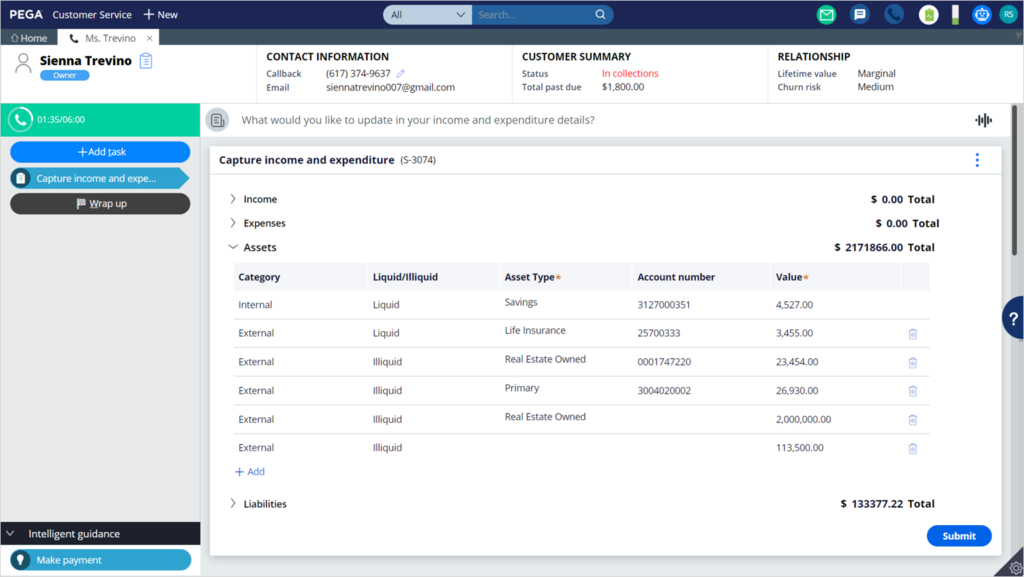

Capture income and expenditure

This Capture income and expenditure service request type lets the collector capture a customer's income and expenditure details, with which the business can calculate the customer's disposable income and determine appropriate payments between creditors. This data can also be used to determine eligibility for hardship programs, both short and long term.

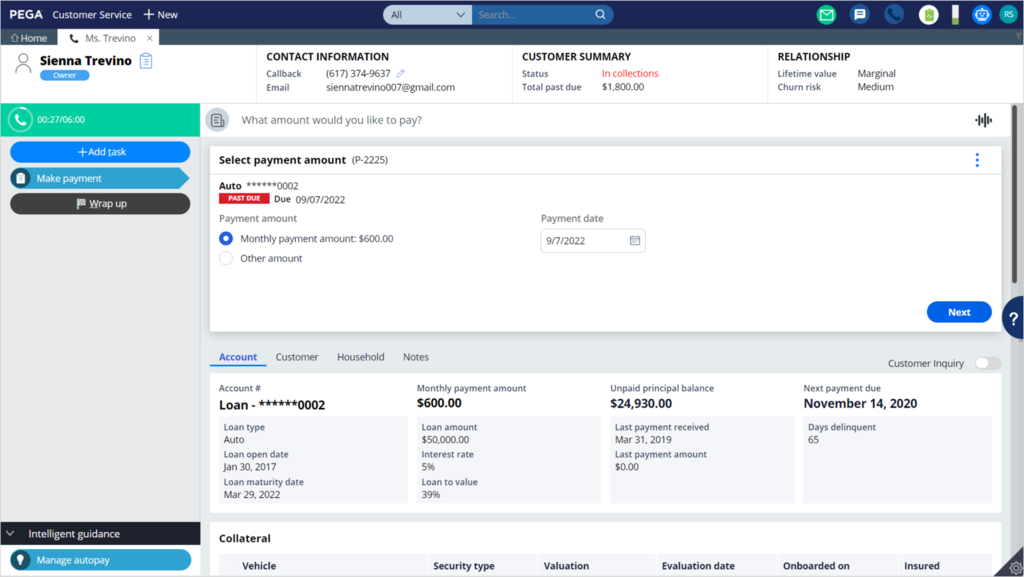

Make payment

The Make payment service request type allows the CSR to either record a customer's promise to send in a payment (check), pay at a branch, or to authorize a credit card, debit card, wire, or internal transfer transaction.

If the payment method selected is Internal Transfer, an Authorize checkbox indicates that the customer is authorizing the bank to collect the funds, or create an Automated Clearing House (ACH) transaction to pull the funds from another bank-held account. The audit trail automatically captures a history of this action.

This Topic is available in the following Module:

If you are having problems with your training, please review the Pega Academy Support FAQs.

Want to help us improve this content?