Due diligence essentials

In the Pega Client Lifecycle Management (CLM) and Know Your Customer (KYC) application, the Due diligence stage of a customer journey is designed to accommodate any work necessary to understand the risk of doing business with a customer. This work can vary significantly in volume, complexity, and the number of departments involved. A highly flexible solution ensures that work can flow through the organization as efficiently as possible with the necessary checks and audits completed as it progresses.

The Due diligence stage includes the five main categories of this work:

- Anti-Money Laundering (AML)

- Regulatory

- Tax

- Credit

- Legal

You can add new categories or extend the existing ones. For more information on the configuration of categories and the way in which the necessary work can flow through the organization, see Due diligence orchestration mode.

In the following image, click the + icons to learn more about each category of work in the Due diligence stage.

For AML, Regulatory, and Tax tasks, the Pega CLM and KYC application implements specific flows and questionnaires that help your organization ensure compliance. The Credit and Legal categories of due diligence are typically very client-specific. The application includes the categories as two placeholders cases that you can extend with the wide set of Pega Platform™ and Pega Foundation for Financial Services capabilities.

Due diligence questions

To understand the risk of engaging in business with a customer, users must answer a series of questions and, in certain cases, provide supporting evidence. For example, an application captures and verifies a full legal name through documentation as part of onboarding a new individual customer.

In order to speed up implementations, the financial institution can reuse thousands of preconfigured questions available in the application’s extensive set of regulatory questionnaires. From the simplest to the most complex business scenario, the Pega CLM and KYC application provides several ways to ensure that only the necessary questions are displayed to the appropriate users at the right time.

The following components comprise the questionnaires that the users see in your application:

- Question (Pega CLM and KYC Items): The component facilitates capturing a single or a small set of similar data, such as date of birth or set of addresses. To help the users and reduce errors, you can configure different types of responses, such as Yes or No, a dropdown list, a free text field, and the ability to capture multiple answers to a question as required.

- Question Group (Item Group): The component facilitates the logical grouping of questions for a better user experience. They can be expanded or collapsed on the user interface, allowing the user to scan through longer questionnaires more easily.

- Questionnaire (Pega KYC Type): The component facilitates the logical grouping of one or more sets of questions as questionnaires for organization and easy maintenance. End users can see one or more questionnaires at a time.

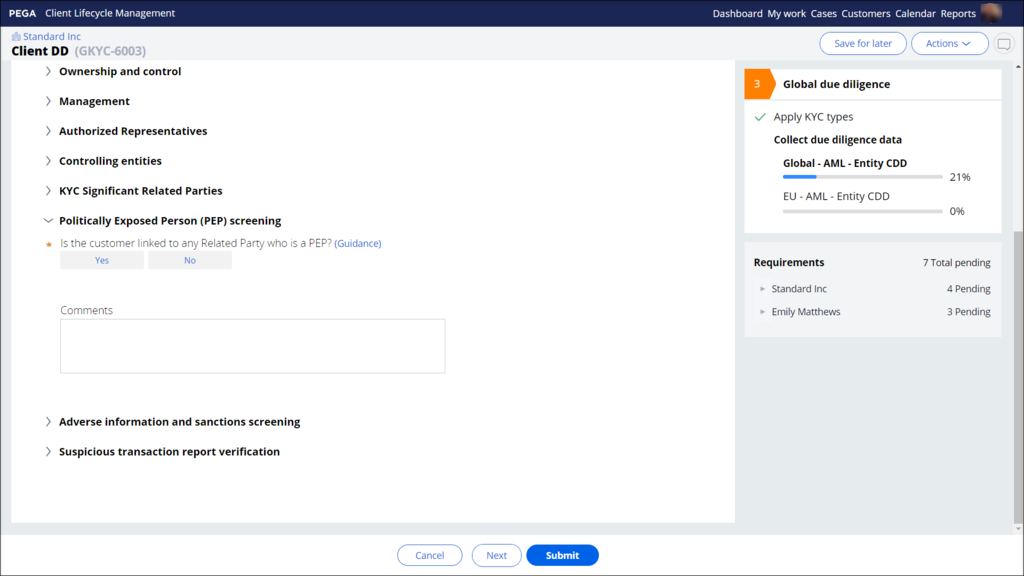

The following image shows an example of a question in the group from the Global Entity Customer Due Diligence questionnaire.

A set of mechanisms fully control when any questionnaire, set of questions, or individual question is displayed to users. The display of questionnaires is based on a matrix of business logic: the Applicability Matrix. The matrix considers different factors to determine the applicability of a questionnaire. The number of driver factors is large, and you can extend the driver factors as required. The following factors are some of the most important ones that the Pega CLM and KYC application uses:

- The type of customer that undergoes onboarding, such as Individual or Organization.

- The jurisdictions in which the customer has products, such as the US or India.

- The types of products which the customer wants to buy, such as Derivatives or Swaps.

At the same time, the group of questions or an individual question can be displayed or hidden based on specific logic set at that particular level. For example, a group of questions that are specific to an entity type of Trust is only displayed when the value of the Entity Type for an organization is equal to Trust. You can then articulate the applicability logic differently by using decision rules such as decision tables or decision trees.

You can also control the visibility or applicability of items and groups by using Due Diligence Profiles. Each customer or related party in the system is automatically assigned a Due Diligence Profile level, which drives any questions that are displayed across the questionnaires. Out of the box, there are four levels of the profile with separate sets to distinguish between customers and related parties:

- Due Diligence Exempt

- Simplified Due Diligence

- Full Due Diligence

- Enhanced Due Diligence

The Pega CLM and KYC application uses these profiles to ensure that more questions are presented to users as the level of the Due Diligence Profile increases.

For more information, see the Pega Know Your Customer Engine guide.

KYC case overview

The Pega CLM and KYC application facilitates completing the required questionnaires by arranging them into a series of KYC cases. The KYC case skips or modifies certain stages and steps according to the distinct types of due diligence. Based on the configuration in place, there are five potential stages in KYC cases:

- Related party KYC

- Customer investigation

- Global due diligence

- KYC Review

- Local due diligence

The mode of due diligence orchestration further controls the number of cases and the questionnaires in the cases. The level of complexity in which the financial institution operates drives the necessary mode of due diligence orchestration that must be configured. For more information, see Due diligence orchestration mode.

In the following image, click the + icons to learn more about the different stages of the Due Diligence case template.

Note: The stages in the diagram are based on the due diligence orchestration configured in Standard mode. For more information about the key differences in the use of the KYC case template across the Intermediate and Simplified modes, see Due diligence orchestration mode.

Check your knowledge with the following interaction:

This Topic is available in the following Modules:

If you are having problems with your training, please review the Pega Academy Support FAQs.

Want to help us improve this content?