Entry and exit criteria

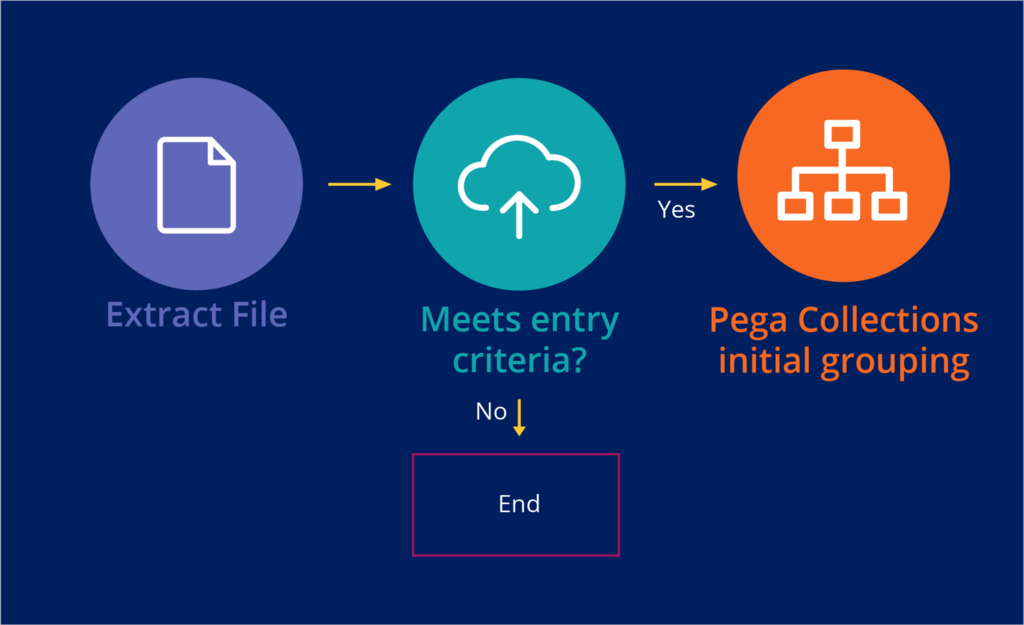

The collections application receives a file that contains a list of collection cases. This process often occurs in an overnight batch, but depending on the requirements of the business, file intake can also happen on a more frequent basis.

This file includes new cases to create and updates to existing cases. The business is mainly responsible for the creation of this extract and is in control of the criteria that determine whether to include an account in the file.

Entry rules define when case creation takes place in Pega Collections™. The rules are helpful when defining criteria in a decision table, which can be easier to control than the definition of the extract. Often, the extract provides only a fundamental level of control and can be difficult to modify. For example, the extract might include all the accounts from one day and one cent past due, but a business might want to process cases only once the cases age to five days and USD5 past due. Creating a set of entry criteria, equips the business with an additional level of control.

The Pega Collections implementation team initially defines a set of entry criteria to determine which cases from the file extract are imported into the application as collections cases.

The collections application might select customers for processing for various reasons. In addition to non-payment, the reasons may include exceeding a credit limit or a high risk of delinquency that requires additional support. Customer accounts are typically included in the file feed of collections cases when they meet the criteria for the following categories:

Arrears

An account is in arrears when the debt is overdue and unpaid. Consequently, the most common criterion is the measure of days past. Another common one is the measure of balance, and the latter excludes minimal values from the processing of the collection (often set at around USD5).

Over limit

Some organizations also define accounts that are over their credit limit as being delinquent and require activities that the collections application delivers. Customers with balances higher than those assigned by the risk logic present a risk to the organization, as the exposure to bad debt becomes higher than the calculated acceptable level.

A common way to calculate the entry rules for over-limit accounts is by using the following formula: over limit amount > $x or x% of limit. Over-limit cases do not have days-past-due criteria applied to them. If customers are in arrears, they are in the arrears cases category.

Preemptive

Some customers might be at a high risk of going into arrears even before they miss a payment. Identifying these customers and loading them into collections for a preemptive contact strategy can be valuable and prevent them from going into arrears. These strategies have a heavy customer service and educational focus. The business can load these customers into collections even though they do not meet the entry criteria (for example, their days past due and arrears value are equal to zero).

Skip trace

Skip trace refers to locating a customer whose contact information is outdated or invalid. Some organizations decide to perform a skip trace as an internal collections function. Entry rules might have to accommodate non-delinquent cases where the status of a customer indicates that the address or contact details are not up to date.

Special circumstances

Organizations might want to process a case in the collections application when a customer is subject to a special circumstance such as bankruptcy or a health issue. These cases can be delinquent or non-delinquent. The entry rules might need to accommodate entry to collections based on a specific status, regardless of their days past due or arrears balance.

Force and stay

Sometimes, customers are not yet active in collections, but they contact the collections operation in anticipation of issues that might prevent them from maintaining contractual payments on their accounts. In such cases, it can be invaluable to proactively bring the account into collections and assist the customer with special payment programs and processes that are available only in collections. The solution allows the collections specialists to force an account into collections to facilitate this use case.

Exit criteria

Exit criteria are Pega Collections application rules that define when a case can change its status to Resolved-Completed. For example, the criteria might determine that a case is complete when there is no longer an entry associated with it in the extract file. The business might also define the exit rules as the reverse of the entry rules; for example, the case is complete if the arrears are <$x and the number of days past due is < y.

Exit criteria also include rules that are specific to the maintenance of special circumstance cases, with relation to which arrears and days past count may not be applicable. For example, a customer can be in collections for deceased processing, and their arrears amount might be zero. In such a case, exit rules allow only for the exit of special circumstance cases when all processes are completed. In special circumstance cases, the business usually controls exit and closure manually.

This Topic is available in the following Module:

If you are having problems with your training, please review the Pega Academy Support FAQs.

Want to help us improve this content?