Grouping

Familiarize yourself with the language and common practices associated with the more traditional collections operations, in which the contact strategy definition often still references segments and groups of customers. It is important to understand legacy account structure so that you understand how some organizations seek to collect debt.

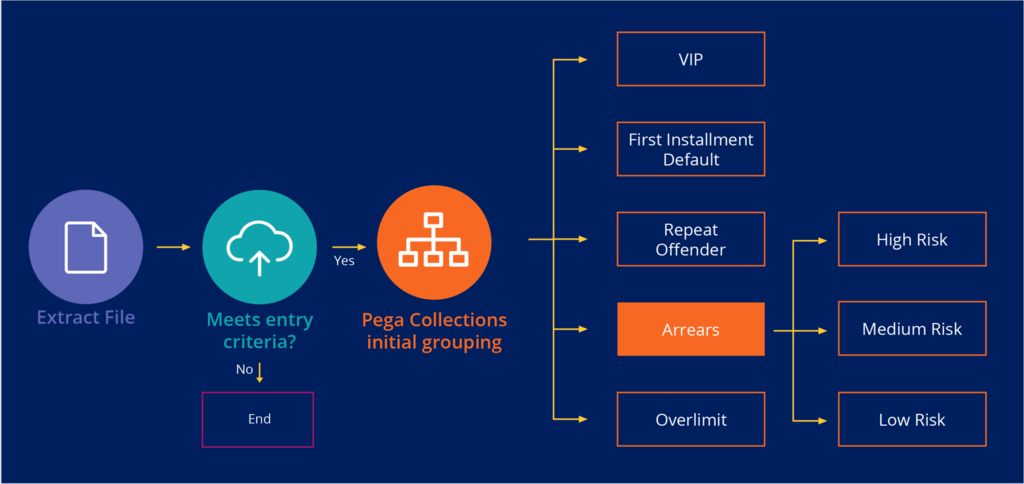

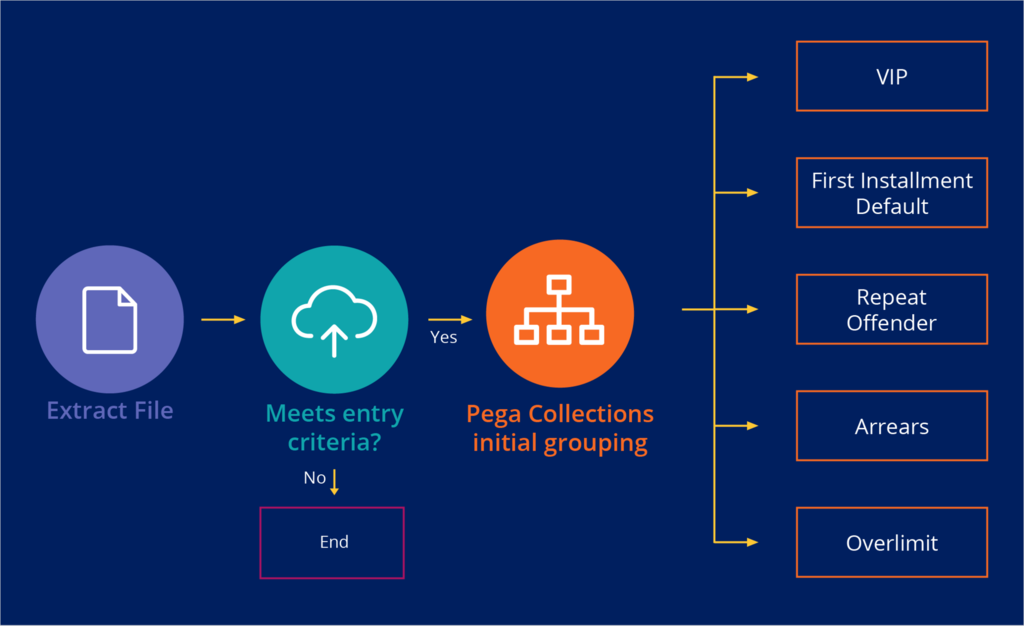

In the legacy account structure, once accounts have passed the initial entry criteria, they might require further assessment and, potentially, grouping. This allows the business to define which actions and processes they need to apply to the accounts.

Some elements of these more traditional groupings may still be relevant, even as an organization evolves to a more dynamic treatment choice using Pega Customer Decision Hub™ (CDH) and adaptive modeling to select the most successful customer-level contact strategy. For example, an organization might choose to stream out VIP customers and assign a deterministic contact strategy for such customers.

Groupings such as Repeat Offender and First Installment Default could provide good targets for dynamic contact strategy selection using CDH, as these could become customer criteria that will drive a differentiated approach, rather than requiring a specific group for deterministic contact strategy. For example, a customer who is constantly going in and out of arrears would be categorized as a 'repeat offender' in more traditional contact strategy design. However, with CDH adaptive modeling, the customer behavior would itself direct a contact strategy that is focused on improving the customer's behavior, such as by recommending autopay and other tactics, without the need for building deterministic group and strategy.

The diagram below shows an example of a traditional initial collections case grouping. The business determines their own grouping requirements and then defines the rules that support the grouping within Pega Collections, in Customer Decision Hub.

VIP

This special group of customers requires specific and potentially more personalized treatment.

First Installment Default

The First Installment Default (FID) group includes customers who have missed their first payment on a credit contract. This can be due to a service issue, such as bad data on an automated payment, a returned payment, or even fraud. All such cases require close scrutiny. Collection specialists can use bank return codes to understand why a customer missed a payment and automate the next steps accordingly. For example, if the reason code indicates bad data, a call to the customer can verify if it was a data entry issue or fraud. If the reason code indicates insufficient funds or a closed account, this can indicate a high risk and require actions such as suspension of the credit function and initiating high-risk customer contact strategies.

Repeat Offender

If a customer has had multiple instances of arrears within a specified time frame, then they can be categorized as a repeat offender. In such cases, the organization can implement a specific strategy to manage this group of customers. They can range from education strategies that inform customers of automated payments, to escalated strategies that learn what prompted the payment previously and escalate the customer to that stage more rapidly.

Arrears

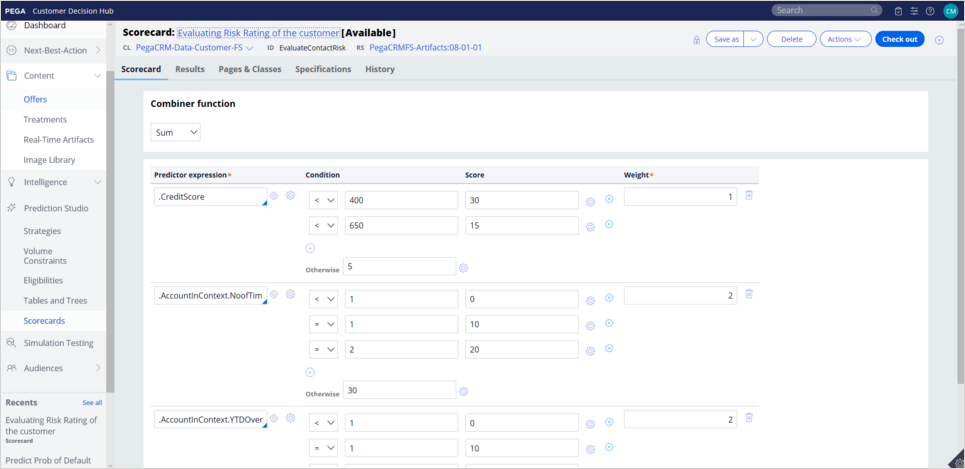

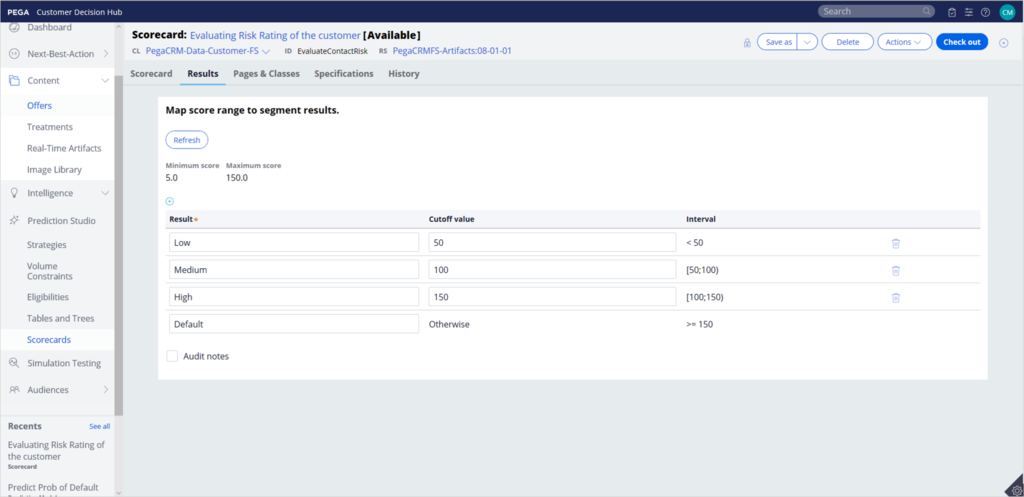

Having defined the criteria to create the group for Arrears cases, it is common for the business to then create additional grouping logic for cases of similar risk. In collections, risk is predominantly a measure of the probability that the case will eventually be written off as bad debt. When someone talks about a high-risk case, they are referring to a case which has a high probability of becoming bad debt.

The following screenshots show an example of how risk ratings have been determined within the Customer Decision Hub using the scorecard rules.

Clients can have their own requirements for determining risk.

Note: that the client can also import scores from external sources and consume these within the business logic. For more details, see the Importing a PMML model.

Over Limit

The Over Limit group of customers can be initially divided into customers that are providing a level of payment that supports their over limit balance, and those that are not paying or not paying enough to support their balance. It is common practice for a business to treat their customers who are over limit and not paying, or not paying enough, as arrears customers, and stream them to an arrears contact strategy path. Similarly, as with the arrears customers, the business may decide to sub-group by risk the customers who are paying enough to cover their balances.

Contact strategies for over-limited customers are also similar to arrears strategies. They involve contacting the customer by phone, e-mail, post, and text messages, with the objective of negotiating a payment plan to bring the balance back within the terms of their agreement.

Note: Most financial organizations will automatically increase a customer's credit limit as their balance approaches the set limit. However, customers who do not qualify for automated credit limit increases may go over their assignment limit.

This Topic is available in the following Module:

If you are having problems with your training, please review the Pega Academy Support FAQs.

Want to help us improve this content?