KYC regulatory compliance

KYC regulatory compliance is a package of regulatory questionnaires and relevant business rules that Know Your Customer provides with the KYC engine by default.

You can use the set of preconfigured KYC Types as a design model for your own KYC Types or as reusable assets during the Pega Client Lifecycle Management and KYC application implementations. As a result, the questionnaires that the KYC regulatory compliance package includes are not compliant by default with the regulations because you can never outsource the managing of the risks of having a business relationship with customers. However, the best practice is to adapt the questionnaires to your risk appetite dictated by your policy and procedures.

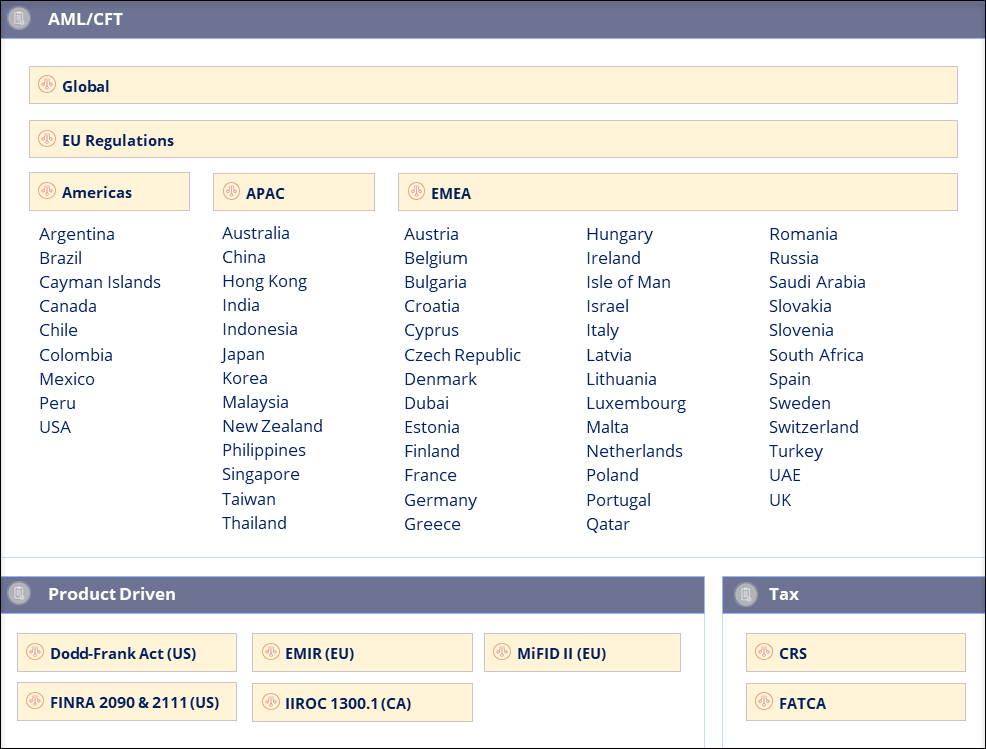

The KYC regulatory compliance package offers a comprehensive suite of regulatory rules across three areas:

- AML/CFT

- Product-driven regulations on suitability, and OTC derivatives and swaps

- Tax

The following figure shows the table with covered regulations:

For an updated list of all the out-of-the-box questionnaires, see the KYC documentation that is relevant to the product version of the client.

The AML/CFT regulatory questionnaires cover 59 countries across three geographical regions:

- Americas

- Asia-Pacific (APAC)

- Europe, the Middle East, and Africa (EMEA)

Due to the complexity of its requirements, Dubai is a separate country from the United Arab Emirates (UAE), so the total number of jurisdictions covered by the KYC regulatory compliance is 60.

For each jurisdiction, there is a minimum of two questionnaires. For example, the AML/CFT Entity Customer Due Diligence (CDD) and the AML/CFT Individual CDD, which, from a due diligence level perspective, contain the SDD and FDD requirements. And there is a maximum of four questionnaires: the two CDD as mentioned earlier ones and then the two questionnaires including the EDD requirements, again one for entities and one for individuals.

Among all requirements that are established by product-driven regulations, the questionnaires focus on the classification of the customer, which is the foundation for other requirements, such as suitability, appropriateness, clearing, and reporting obligations.

The CSV workbooks that cover CRS and FATCA regulations do not comprise all requirements in those tax regulations because their scope is to determine the tax status of the customer and the relevant data or documents (for example, tax forms).

The creation and maintenance of the workbooks are the results of a joint effort between an external law firm (for example, Mintz) and the Pega Client Lifecycle Management (CLM) team. The law firm reviews and interprets the regulations in scope and provides the relevant input for changing existing workbooks or creating new ones. At the same time, the Pega CLM team operationalizes the regulatory rules in the application to make the workbooks efficient and user-friendly.

The KYC regulatory compliance is a reference library for clients to use and extend to support their regulatory needs in various areas.

Check your knowledge with the following interaction:

This Topic is available in the following Module:

If you are having problems with your training, please review the Pega Academy Support FAQs.

Want to help us improve this content?