Defining action suppression rules

Introduction

Suppression rules determine when and for how long an action or group of actions should not be shown to a customer. These suppression rules put an action on hold after a specific number of outcomes are recorded for some or all channels.

Video

Transcript

This demo will show you how to suppress a single action or group of actions for a limited time period.

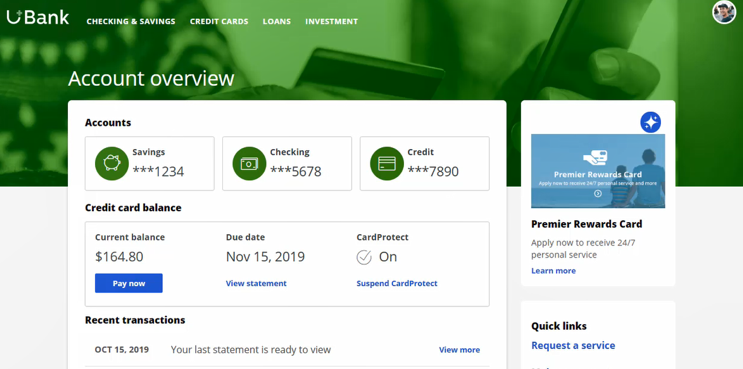

U+, a retail bank, currently displays various credit card offers to each customer who logs in to the website.

For example, every time Troy logs in to his accounts page, a credit card offer is shown. Sometimes the same offer is shown multiple times.

For a limited time period, the bank wants to automatically suppress offers that are shown or clicked too often.

In this scenario, the bank has two requirements. First, do not show a credit card for ten days if the card was shown three times in the last seven days.

Second, do not show any credit cards for ten days if a user has clicked on a credit card five times in the last seven days.

Contact policies are used to implement these business requirements. You create contact policies in Next-Best-Action Designer.

On the Constraints tab, you can define the suppression rules by creating contact policy rules.

For the first requirement, showing a credit card a maximum of three times, configure a contact policy to track Impressions at the Action level.

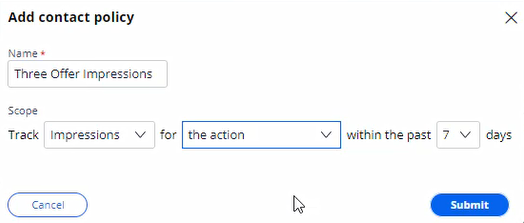

Provide a name for the contact policy.

Then select the type of outcome that will be tracked by the contact policy, in this case Impressions.

You can specify whether the responses are tracked for one specific action, or for all actions in the group. Track the first requirement at the Action level, since you want to show one specific card a maximum of three times.

You can select the time period over which the responses should be tracked. In this case, responses should be tracked over a period of seven days.

The newly configured contact policy has been added.

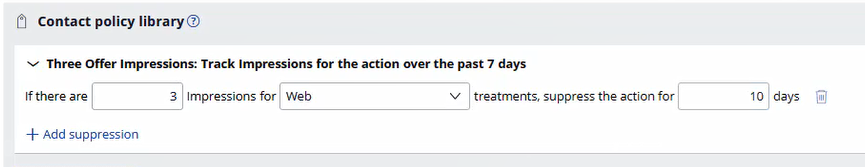

The first business requirement is to suppress the action for ten days if there are three impressions for the web treatment, so fill in the details accordingly.

Enter the number of responses required to fulfill the suppression criteria.

Select the channel for which the responses are tracked. Note that if you want to track impressions across multiple channels, you can select Any.

Enter the number of days for which an action should be paused after the suppression criteria are met.

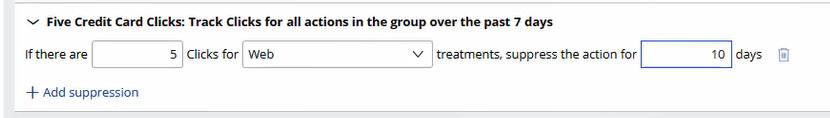

The next business requirement is to suppress the entire group of actions if there are five clicks for web treatments.

The first contact policy is configured to track Impressions, so add another contact policy.

For this requirement you will be tracking Clicks for all actions in the group. This because you want to hide all credit cards if there are five clicks on any one credit card.

Once the contact policy is created, fill in the suppression rule details. If there are five clicks on web treatments, suppress the action for ten days.

Save the changes.

The contact policy rules are reusable as policy rules across all business issues and groups.

As the bank wants to suppress credit card offers, open the CreditCards group.

Add the contact policy rules you just created.

With that, all the necessary configuration for this scenario is complete. Save the changes.

When customer Troy logs in to his accounts page, the Premier Rewards Card offer is displayed.

After showing him this offer three times, it is automatically suppressed, and a different credit card offer is shown.

When customer Barbara logs in to her accounts page, a credit card offer is displayed.

After clicking on any credit card offer five times, the credit card offers are not shown again.

This demo has concluded. What did it show you?

- How to define contact policy rules to suppress a single action or group of actions.

This Topic is available in the following Module:

If you are having problems with your training, please review the Pega Academy Support FAQs.

Want to help us improve this content?